| • レポートコード:IMA0923UQ335 • 出版社/出版日:IMARC / 2025年3月 • レポート形態:英語、PDF、約120ページ • 納品方法:Eメール(納期:2日) • 産業分類:材料 |

| Single User | ¥455,848 (USD2,999) | ▷ お問い合わせ |

| Corporate User | ¥759,848 (USD4,999) | ▷ お問い合わせ |

• お支払方法:銀行振込(納品後、ご請求書送付)

レポート概要

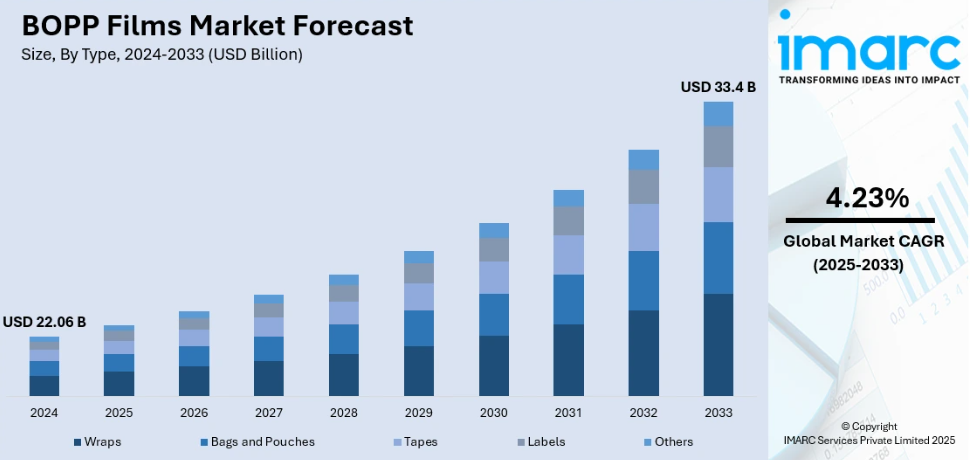

| 世界のBOPP(延伸ポリプロピレン)フィルム市場は2024年に220億6000万米ドルと評価され、2033年には334億米ドルに達すると予測され、2025~2033年の年平均成長率(CAGR)は約4.23%です。主にアジア太平洋地域が市場を牽引しており、2024年には市場シェアの46.5%以上を占めています。BOPPフィルムは高い透明性、耐湿性、優れた引張強度、低コストといった特性を持ち、包装、ラベル、ラミネート用途で広く利用されています。また、リサイクル可能で印刷適性が高いため、持続可能な包装材として注目されています。 市場成長の背景には、食品・飲料・医薬品業界における柔軟包装の需要拡大があります。BOPPフィルムは酸素や水分を遮断し、製品の鮮度を保持できるため、包装の品質向上に寄与しています。特にインドなど新興国では包装食品の消費が急増しており、今後の需要拡大が見込まれます。加えて、環境規制の強化により、メーカーはリサイクル可能・バイオベース素材への移行を進めています。eコマースの発展も軽量で耐久性のあるBOPPフィルムの需要を押し上げており、技術革新による高性能バリアコーティングや表面処理の進歩が市場拡大を後押ししています。 用途別では、包装分野が最大の需要先であり、特に食品包装が全体の28%以上を占めます。BOPPフィルムはスナック、菓子、ベーカリー製品の保存性を高める用途で重宝され、利便性を重視する消費者ニーズと相まって需要が増加しています。厚さ別では、15~30ミクロンのフィルムが最も広く利用されており、コストと性能のバランスに優れています。一方で、15ミクロン未満の超薄型フィルムは持続可能性や軽量化の観点から採用が増加しており、包装効率の改善に寄与しています。製造工程別では、二軸延伸を行うテンター法が主流で、2024年時点で市場の58%を占めます。この方法により、機械方向と横方向の両方に延伸されたフィルムは、高い透明性と機械的強度を備えています。 地域別では、アジア太平洋地域が市場を牽引しており、中国、日本、インドなどで需要が拡大しています。特にインドでは食品・飲料包装市場が2023年の337億ドルから2028年には463億ドルに拡大すると予測されており、BOPPフィルムの採用が進んでいます。さらに、現地政府によるリサイクル促進政策や外資系投資の拡大が市場拡大を支えています。北米では、食品・飲料、医薬品、消費財分野の成長とともに持続可能な包装需要が増加しています。アメリカではフレキシブル包装業界の売上が2022年に415億ドルに達しており、再生可能素材への転換が進んでいます。ヨーロッパでは環境規制が厳しく、欧州グリーンディールの目標に沿って生分解性BOPPフィルムへの移行が進行中です。 競争環境としては、主要企業が研究開発や生産能力拡大に積極的に取り組んでいます。JPFL Filmsは2024年にインドで年産6万トン規模の新工場建設を発表し、市場シェアの拡大を図っています。その他、Amcor、Mondi、Toray、Uflex、Jindal Poly Filmsなどが参入し、環境対応型製品や高付加価値フィルムの開発を進めています。業界全体としては、再利用可能で高性能な包装材への需要が中長期的に拡大しており、BOPPフィルム市場は今後も安定した成長を続ける見通しです。 |

The global BOPP films market size was valued at USD 22.06 Billion in 2024. The market is projected to reach USD 33.4 Billion by 2033, exhibiting a CAGR of 4.23% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 46.5% in 2024. The market is witnessing significant growth due to the desirable properties of BOPP films, such as high clarity, moisture resistance, excellent tensile strength, and cost-effectiveness. These films are widely used in packaging, labeling, and lamination across industries like personal care. Their recyclability and adaptability to advanced printing techniques are enhancing their appeal, which is contributing to the expansion of the BOPP films market share.

The BOPP films market is driven by rising demand for flexible packaging solutions across food, beverage, and pharmaceutical sectors due to their superior barrier properties, durability, and recyclability. Increasing consumer preference for packaged and convenience foods, coupled with advancements in film technology, is further enhancing market growth. For instance, as per industry reports, in 2024 India’s packaged food consumption stood at approximately 7%, with significant potential to grow to 20% over the years. Sustainability initiatives and stringent regulations are pushing manufacturers toward eco-friendly, recyclable, and bio-based films, aligning with global circular economy goals. Additionally, the rapid expansion of e-commerce, requiring durable and lightweight packaging materials, and continuous innovations in barrier coatings and film treatments are propelling the market’s upward trajectory.

The United States plays a significant role in the global BOPP films market, driven by advancements in packaging technologies and the increasing demand for sustainable materials. The growth of industries, such as food and beverages, pharmaceuticals, and consumer goods, fuels the adoption of BOPP films, valued for their superior barrier properties and recyclability. In addition, manufacturers are actively investing in innovative film solutions to meet regulatory requirements and evolving consumer preferences for eco-friendly packaging. Moreover, the expanding e-commerce sector further boosts demand for durable and lightweight packaging, positioning the United States as a key contributor to the global BOPP films market. For instance, as per industry reports, the United States e-commerce sector is poised for substantial growth, with projections estimating a market size of USD 2.29 Trillion by 2028.

BOPP Films Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global BOPP films market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, thickness, production process, and application.

Analysis by Type:

• Wraps

• Bags and Pouches

• Tapes

• Labels

• Others

Bags and pouches stand as the largest component in 2024, holding around 54.2% of the market. This segment is primarily driven by the increasing consumer demand for convenient, lightweight, and flexible packaging solutions. Bags and pouches benefit from the superior properties of films, such as clarity, strength, and barrier resistance, making them ideal for a variety of products ranging from food to personal care items. The trend towards more sustainable packaging options has also contributed to the growth of this segment, as films are recyclable and offer a reduced environmental footprint compared to other materials.

Analysis by Thickness:

• Below 15 microns

• 15-30 microns

• 30-45 microns

• More than 45 microns

Analysis by Production Process:

• Tenter

• Tubular

Analysis by Application:

• Food

• Beverage

• Tobacco

• Personal Care

• Pharmaceutical

• Electrical and Electronics

• Others

The report provides a comprehensive analysis of the competitive landscape in the BOPP films market with detailed profiles of all major companies, including:

• Altopro S.A. de C.V.

• Amcor Plc

• Ampacet Corporation

• Chiripal Poly Films Limited

• Clondalkin Flexible Packaging

• Cosmo Films Limited

• Futamura Chemical Co. Ltd.

• Innovia Films Limited (CCL Industries)

• Jindal Poly Films Limited

• Mondi Plc

• Polyplex Corporation Ltd.

• Printpack Holdings Inc.

• Toray Industries Inc.

• Uflex Ltd.

1 Preface

2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global BOPP Films Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Type

6.1 Wraps

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Bags and Pouches

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Tapes

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Labels

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Others

6.5.1 Market Trends

6.5.2 Market Forecast

7 Market Breakup by Thickness

7.1 Below 15 microns

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 15-30 microns

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 30-45 microns

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 More than 45 microns

7.4.1 Market Trends

7.4.2 Market Forecast

8 Market Breakup by Production Process

8.1 Tenter

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Tubular

8.2.1 Market Trends

8.2.2 Market Forecast

9 Market Breakup by Application

9.1 Food

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Beverage

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Tobacco

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Personal Care

9.4.1 Market Trends

9.4.2 Market Forecast

9.5 Pharmaceutical

9.5.1 Market Trends

9.5.2 Market Forecast

9.6 Electrical and Electronics

9.6.1 Market Trends

9.6.2 Market Forecast

9.7 Others

9.7.1 Market Trends

9.7.2 Market Forecast

10 Market Breakup by Region

10.1 North America

10.1.1 United States

10.1.1.1 Market Trends

10.1.1.2 Market Forecast

10.1.2 Canada

10.1.2.1 Market Trends

10.1.2.2 Market Forecast

10.2 Asia Pacific

10.2.1 China

10.2.1.1 Market Trends

10.2.1.2 Market Forecast

10.2.2 Japan

10.2.2.1 Market Trends

10.2.2.2 Market Forecast

10.2.3 India

10.2.3.1 Market Trends

10.2.3.2 Market Forecast

10.2.4 South Korea

10.2.4.1 Market Trends

10.2.4.2 Market Forecast

10.2.5 Australia

10.2.5.1 Market Trends

10.2.5.2 Market Forecast

10.2.6 Indonesia

10.2.6.1 Market Trends

10.2.6.2 Market Forecast

10.2.7 Others

10.2.7.1 Market Trends

10.2.7.2 Market Forecast

10.3 Europe

10.3.1 Germany

10.3.1.1 Market Trends

10.3.1.2 Market Forecast

10.3.2 France

10.3.2.1 Market Trends

10.3.2.2 Market Forecast

10.3.3 United Kingdom

10.3.3.1 Market Trends

10.3.3.2 Market Forecast

10.3.4 Italy

10.3.4.1 Market Trends

10.3.4.2 Market Forecast

10.3.5 Spain

10.3.5.1 Market Trends

10.3.5.2 Market Forecast

10.3.6 Russia

10.3.6.1 Market Trends

10.3.6.2 Market Forecast

10.3.7 Others

10.3.7.1 Market Trends

10.3.7.2 Market Forecast

10.4 Latin America

10.4.1 Brazil

10.4.1.1 Market Trends

10.4.1.2 Market Forecast

10.4.2 Mexico

10.4.2.1 Market Trends

10.4.2.2 Market Forecast

10.4.3 Others

10.4.3.1 Market Trends

10.4.3.2 Market Forecast

10.5 Middle East and Africa

10.5.1 Market Trends

10.5.2 Market Breakup by Country

10.5.3 Market Forecast

11 SWOT Analysis

11.1 Overview

11.2 Strengths

11.3 Weaknesses

11.4 Opportunities

11.5 Threats

12 Value Chain Analysis

13 Porters Five Forces Analysis

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Competition

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14 Price Analysis

15 Competitive Landscape

15.1 Market Structure

15.2 Key Players

15.3 Profiles of Key Players

15.3.1 Altopro S.A. de C.V.

15.3.1.1 Company Overview

15.3.1.2 Product Portfolio

15.3.2 Amcor Plc

15.3.2.1 Company Overview

15.3.2.2 Product Portfolio

15.3.3 Ampacet Corporation

15.3.3.1 Company Overview

15.3.3.2 Product Portfolio

15.3.4 Chiripal Poly Films Limited

15.3.4.1 Company Overview

15.3.4.2 Product Portfolio

15.3.5 Clondalkin Flexible Packaging

15.3.5.1 Company Overview

15.3.5.2 Product Portfolio

15.3.6 Cosmo Films Limited

15.3.6.1 Company Overview

15.3.6.2 Product Portfolio

15.3.6.3 Financials

15.3.7 Futamura Chemical Co. Ltd.

15.3.7.1 Company Overview

15.3.7.2 Product Portfolio

15.3.8 Innovia Films Limited (CCL Industries)

15.3.8.1 Company Overview

15.3.8.2 Product Portfolio

15.3.8.3 Financials

15.3.9 Jindal Poly Films Limited

15.3.9.1 Company Overview

15.3.9.2 Product Portfolio

15.3.9.3 Financials

15.3.10 Mondi Plc

15.3.10.1 Company Overview

15.3.10.2 Product Portfolio

15.3.10.3 Financials

15.3.10.4 SWOT Analysis

15.3.11 Polyplex Corporation Ltd.

15.3.11.1 Company Overview

15.3.11.2 Product Portfolio

15.3.11.3 Financials

15.3.12 Printpack Holdings Inc.

15.3.12.1 Company Overview

15.3.12.2 Product Portfolio

15.3.12.3 SWOT Analysis

15.3.13 Toray Industries Inc.

15.3.13.1 Company Overview

15.3.13.2 Product Portfolio

15.3.13.3 Financials

15.3.13.4 SWOT Analysis

15.3.14 Uflex Ltd.

15.3.14.1 Company Overview

15.3.14.2 Product Portfolio

List of Figures

Figure 1: Global: BOPP Films Market: Major Drivers and Challenges

Figure 2: Global: BOPP Films Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: BOPP Films Market: Breakup by Type (in %), 2024

Figure 4: Global: BOPP Films Market: Breakup by Thickness (in %), 2024

Figure 5: Global: BOPP Films Market: Breakup by Production Process (in %), 2024

Figure 6: Global: BOPP Films Market: Breakup by Application (in %), 2024

Figure 7: Global: BOPP Films Market: Breakup by Region (in %), 2024

Figure 8: Global: BOPP Films Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 9: Global: BOPP Films (Wraps) Market: Sales Value (in Million USD), 2019 & 2024

Figure 10: Global: BOPP Films (Wraps) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 11: Global: BOPP Films (Bags and Pouches) Market: Sales Value (in Million USD), 2019 & 2024

Figure 12: Global: BOPP Films (Bags and Pouches) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 13: Global: BOPP Films (Tapes) Market: Sales Value (in Million USD), 2019 & 2024

Figure 14: Global: BOPP Films (Tapes) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 15: Global: BOPP Films (Labels) Market: Sales Value (in Million USD), 2019 & 2024

Figure 16: Global: BOPP Films (Labels) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 17: Global: BOPP Films (Other Types) Market: Sales Value (in Million USD), 2019 & 2024

Figure 18: Global: BOPP Films (Other Types) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: Global: BOPP Films (Below 15 microns) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: Global: BOPP Films (Below 15 microns) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: Global: BOPP Films (15-30 microns) Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: Global: BOPP Films (15-30 microns) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: Global: BOPP Films (30-45 microns) Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: Global: BOPP Films (30-45 microns) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: Global: BOPP Films (More than 45 microns) Market: Sales Value (in Million USD), 2019 & 2024

Figure 26: Global: BOPP Films (More than 45 microns) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 27: Global: BOPP Films (Tenter) Market: Sales Value (in Million USD), 2019 & 2024

Figure 28: Global: BOPP Films (Tenter) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 29: Global: BOPP Films (Tubular) Market: Sales Value (in Million USD), 2019 & 2024

Figure 30: Global: BOPP Films (Tubular) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 31: Global: BOPP Films (Food) Market: Sales Value (in Million USD), 2019 & 2024

Figure 32: Global: BOPP Films (Food) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 33: Global: BOPP Films (Beverage) Market: Sales Value (in Million USD), 2019 & 2024

Figure 34: Global: BOPP Films (Beverage) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 35: Global: BOPP Films (Tobacco) Market: Sales Value (in Million USD), 2019 & 2024

Figure 36: Global: BOPP Films (Tobacco) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 37: Global: BOPP Films (Personal Care) Market: Sales Value (in Million USD), 2019 & 2024

Figure 38: Global: BOPP Films (Personal Care) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 39: Global: BOPP Films (Pharmaceutical) Market: Sales Value (in Million USD), 2019 & 2024

Figure 40: Global: BOPP Films (Pharmaceutical) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 41: Global: BOPP Films (Electrical and Electronics) Market: Sales Value (in Million USD), 2019 & 2024

Figure 42: Global: BOPP Films (Electrical and Electronics) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 43: Global: BOPP Films (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

Figure 44: Global: BOPP Films (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 45: North America: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 46: North America: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 47: United States: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 48: United States: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 49: Canada: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 50: Canada: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 51: Asia Pacific: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 52: Asia Pacific: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 53: China: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 54: China: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 55: Japan: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 56: Japan: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 57: India: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 58: India: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 59: South Korea: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 60: South Korea: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 61: Australia: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 62: Australia: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 63: Indonesia: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 64: Indonesia: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 65: Others: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 66: Others: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 67: Europe: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 68: Europe: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 69: Germany: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 70: Germany: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 71: France: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 72: France: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 73: United Kingdom: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 74: United Kingdom: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 75: Italy: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 76: Italy: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 77: Spain: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 78: Spain: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 79: Russia: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 80: Russia: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 81: Others: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 82: Others: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 83: Latin America: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 84: Latin America: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 85: Brazil: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 86: Brazil: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 87: Mexico: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 88: Mexico: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 89: Others: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 90: Others: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 91: Middle East and Africa: BOPP Films Market: Sales Value (in Million USD), 2019 & 2024

Figure 92: Middle East and Africa: BOPP Films Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 93: Global: BOPP Films Industry: SWOT Analysis

Figure 94: Global: BOPP Films Industry: Value Chain Analysis

Figure 95: Global: BOPP Films Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: BOPP Films Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: BOPP Films Market Forecast: Breakup by Type (in Million USD), 2025-2033

Table 3: Global: BOPP Films Market Forecast: Breakup by Thickness (in Million USD), 2025-2033

Table 4: Global: BOPP Films Market Forecast: Breakup by Production Process (in Million USD), 2025-2033

Table 5: Global: BOPP Films Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 6: Global: BOPP Films Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 7: Global: BOPP Films Market: Competitive Structure

Table 8: Global: BOPP Films Market: Key Players