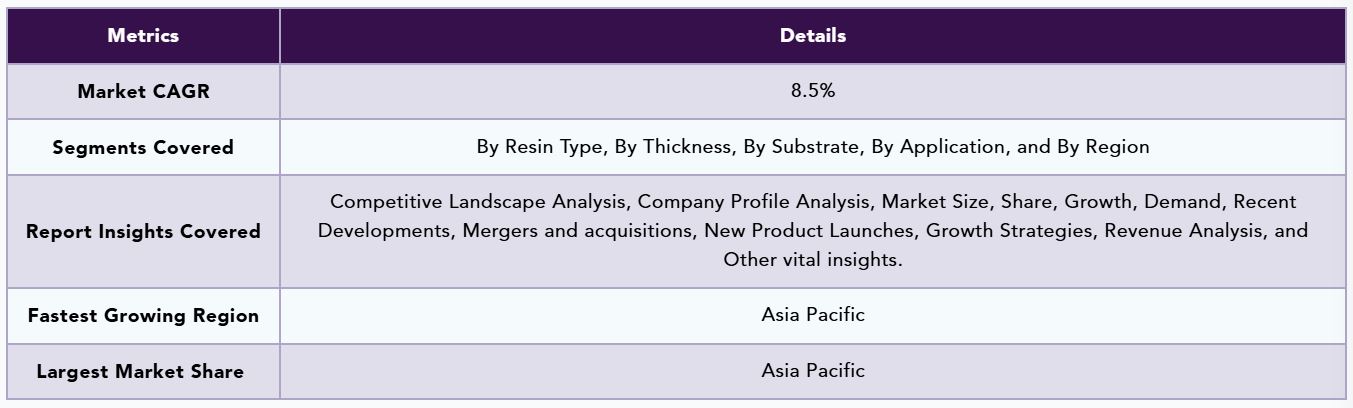

| • レポートコード:MRC722MB448 • 出版社/出版日:DataM Intelligence / 2024年7月 • レポート形態:英語、PDF、約180ページ • 納品方法:Eメール(納期:2日) • 産業分類:材料 |

| Single User | ¥661,200 (USD4,350) | ▷ お問い合わせ |

| Multi User | ¥737,200 (USD4,850) | ▷ お問い合わせ |

| Enterprise License | ¥1,193,200 (USD7,850) | ▷ お問い合わせ |

• お支払方法:銀行振込(納品後、ご請求書送付)

レポート概要

| 光学的透明接着剤(Optically Clear Adhesive, OCA)は、ディスプレイやタッチパネルなどの部品同士を透明かつ歪みなく接着するために使用される、無色透明な接着剤です。高い透明度や接着強度、耐久性、信頼性を兼ね備えており、スマートフォンやタブレット、テレビ、医療機器などに不可欠な材料です。OCAは表示品質を向上させ、スクラッチや化学薬品からの保護にも効果があるため、屋内外問わず多くの電子機器で活用されています。 世界のOCA市場は、スマートデバイスの需要拡大とEコマースの普及によって成長しています。スマートフォンやタブレット、テレビ、医療ディスプレイなどの需要増により、OCAの利用も加速しています。国際通貨基金(IMF)によると、2019年には世界で13.7億台のスマートフォンが販売され、世界人口の半数以上がモバイルデバイスを所有しています。OCAは、こうしたデバイスの透明層を接着し、視認性・コントラスト・読みやすさを改善し、電気的・機械的性能を高める役割を果たします。 また、Eコマースの拡大により、家電製品のオンライン購入が増加し、電子機器メーカーによるOCA採用が加速。2018年には世界のEコマース売上が25.6兆ドルに達し、14億人以上がオンラインショッピングを利用しており、OCA需要を押し上げています。加えて、各社が新技術を活用したデバイスを次々に投入しており、サムスンは世界初の折りたたみスマートフォン向けOCAを開発するなど、技術革新が市場機会を広げています。 COVID-19の影響では、2020年前半に自動車や家電の販売が一時的に減少したものの、オンライン授業や在宅勤務に伴いスマートフォンやタブレットの需要が増加し、OCA市場は回復傾向にあります。 樹脂別では、アクリル系OCAが最も多く使用されており、Techsil社などがUV硬化型アクリルOCAを新たに投入しています。他にも、ポリビニルアセテートやシリコーンなども、電子機器需要の高まりを受けて拡大中です。 厚さ別では、2~3mmのOCAが主流であり、スマートフォンやタブレットなどのパッケージ需要に応えています。基材としては、ガラスやITOガラスが最も使用されており、スマートデバイスの透明接着用途において主役です。エンドユーザー分野では、消費者向け電子機器が最大市場であり、インドや中国でのスマートフォン製造への巨額投資が、さらなるOCA需要を生み出しています。加えて、自動車や医療機器、航空宇宙、建設業界においてもOCA需要は拡大しています。電気自動車や新型車両の登場により、車載用ディスプレイや内装にも透明接着剤のニーズが高まっています。 地域別ではアジア太平洋地域が最大市場であり、特に中国・インド・日本が家電製造の中心地として成長を牽引。インドでは2025年までに家電市場が倍増すると予測されており、OCAの利用拡大が期待されています。北米や欧州でも、スマート・ウェアラブル機器の普及により市場が拡大しています。 主要企業には、日立化成、HBフラー、3M、Nitto(日東電工)、Henkel、LG Chem、Tesaなどがあり、製品開発や設備投資を活発に行っています。たとえばHenkelは米国やインドに新たなOCA製造施設を設立し、UV硬化型アクリル接着剤の生産体制を強化しています。 総じて、OCA市場はグローバルなスマートデバイスの需要拡大、Eコマースの浸透、製造技術の進化を背景に、今後も持続的な成長が見込まれています。 |

Optically clear adhesives (OCA) are transparent and uncoloured adhesives that allow bonding of the entire surface area of a screen to the devices without any distortion display. The optical clarity is an important aspect of these adhesives as it is clean & high in transparency hence used in most critical applications. It helps to improve durability, optical characteristics, adhesive strength and excellent adhesion reliability and high bonding strength. It is used to bind display devices, touch panels, plastic, cover lens and other optic materials like the primary sensor unit with one another to provide a clear visual appearance.

The optically clear adhesive has a wide range of applications such as bonding optical film, cover glass, cover plastic to flat panel displays, electronic devices medical devices flat-screen CRTs etc.

Optically Clear Adhesive Market Dynamics

The global optically clear adhesive is driven by rising demand for consumer electronics with growing internet users and rising E-commerce website sales around the globe. Optically clear adhesive provides dimensional stability, low shrinkage and whitening resistance to the electronics devices such as mobile phones, tablets, smartphones, computers, display screens of medical devices, television sets LCD screens etc.

Rising sale of the consumer’s electronics such as mobile phones, tablets, computers, televisions etc

The market is driven by rising demand for the latest technology-based smart devices, smartphones, tablets, smartphones, computers, display screens of medical devices, television sets and LCD screens. As per the International Monetary Fund Organization, smartphone sales in 2019 reached around 1.37 million units globally and more than half of the world’s population that is around more than 5 billion people have their own mobile devices.

As the optically clear adhesive is used for the binding of the transparent layer in devices to protect against harsh chemicals, damages and scratches. It also improves viewability, readability and contrast in both indoor and outdoor devices, mechanical, optical and electrical performance of the display module and device

Rising number of sales of smart devices with the surge in the use of E-commerce websites due to the rising number of internet users around the globe

An increase in the adoption of the optically clear adhesive by the electronics devices manufacturing industries for providing transparent bonding with growing E-commerce website sales such as from Flipkart, Amazon etc drives the growth of the OCA market. For instance, as per the UNCTAD in 2018, E-commerce sales reached around US$ 25.6 trillion globally increased by 7% from 2017 and over 1.4 billion people shopped online in 2018. The shopping included consumer electronics such as smartphones, tablets, televisions, LED screens etc. It created a massive demand for the OCA used by the OEMs to manufacture and pack these devices.

Growing technological advancement around the globe as several leading players are launching novel electronic devices with considerably growing investment is to produce advanced product may create a huge opportunity for this market

The growing adoption of advanced technology devices around the globe as several leading players are launching novel electronic devices with considerably growing investment for producing newly developed products may create a huge opportunity for the growth of the OCA market. For instance on 11th Sept 2018. Samsung has innovated the world’s first Optically Clear Adhesives for its foldable smartphones and panels.

COVID-19 Impact Analysis on Optically Clear Adhesive Market

The global optically clear adhesive market has shown slightly down during the Covid-19 pandemic, as several leading manufacturing plants were closed due to lockdown in many countries. Further sales of the automobile and consumer electronics were down in the month of the first three months of 2020. In April 2020, the sale of smartphones has been increased as several institutions, schools and colleges closed due to this the demand for the online class propellers ultimately increased the OCA market. Further in August 2020, the OCA market remained constant will recover again as soon as the pandemic will over.

Optically Clear Adhesive Market Segmentation Analysis

The global optically clear adhesive market is segmented based on resin types, thickness, substrate, application and region.

Rising launching of flexible adhesive based on acrylics segment by leading players

In terms of resin type, the global optically clear adhesive market is bifurcated into acrylics, polyvinyl acetate, polyurethane, polypropylene, silicone, epoxy and others. Among these, acrylics have the highest market share in 2019, owing to the rising launching of bonding displays in electronic devices and laminating optics.

For instance, on 8th Nov 2019, Techsil launched Vitralit 50004 a new acrylic-based, optically clear, low viscosity and UV curable adhesive into the UK market. The optically clear adhesive manufactured by the company consists of a one-component acrylic adhesive designed to use for bonding display screens in electronic devices and laminating optics. It offers optimal balance, full re-workability and high bonding strength.

Similarly, polyvinyl acetate, polyurethane, polypropylene, silicone, epoxy segments are also growing due to rising sales of consumer electronics in developing countries rising consumer spending. For instance as per the India Brand Quity Foundation Organization in 2020, electronic manufacturing sector turnover in India has reached around US$ 400 billion in 2020, including foreign direct investment in India of about US$ 100 billion. It created a massive demand for the various types of optically clear adhesive for bonding and providing transparent lamination to electronic devices.

The tapes segment has the highest demand in the electronics industry owing to rising global sale

In terms of form, the global optically clear adhesive market is classified as Less Than 1MM, 1-2 MM, 2-3 MM, 3-4 MM, 4-5 MM and others. Among this, 2-3 MM segment has the highest market share in 2019, this is primarily due to rising demand of the packaging for end-user industries such as consumer electronics such as mobile phones, tablets, etc.

Similarly, 1MM, 1-2 MM, 3-4 MM, 4-5 MM segments are also growing at a faster pace owing to rising demand for the UV resistant curable, bonding of touch panels to cover lens and bonding of displays to cover lens and touch panels.

Based on substrate, the global optically clear adhesive market is classified as Metal, Glass and ITO Glass, Polyethylene Terephthalate (PET), Polymethyl Methacrylate (PMMA), Polycarbonate (PC) and others. Among this Glass and ITO Glass segment has the highest share in 2019, this is primarily due to increasing demand by the consumer electronics manufacturers. It is used as a transparent adhesive for smartphones, tablets, computers, LED, television etc. As the demand for these consumer electronics has been increased substantially which ultimately propels this segmental growth.

The rising sale of smartphones with surge in the number of internets have propelled the OCA segmental growth

The smartphone segment has the highest contribution to the OCA market owing to rising sales with the surge in global demand and rising investment for manufacturing mobile phones around the globe. For instance, on 20th Jan 2020, Samsung invested around US$ 500 million in the establishment of the manufacturing plant for a new smartphone display in Delhi, India.

Based on the end-user, automotive, electronic medical devices, aerospace & avionics, consumer electronics, construction industry and others. Among this consumer electronics segment has the highest market share in 2019, due to the rising sale of electronics appliances with the surge in consumer spending and growing population demand.

Further growing investment by the leading players for the establishment of manufacturing of the mobile phone in developing region such as India, China etc. For instance, India has approved the partnership of Apple and Samsung the investment of around US$ 143 billion smartphone manufacturing plan. It created a massive demand for the OCA market used in the manufacturing of the smartphone.

Similarly automobile, electronic medical devices, aerospace & avionics, construction industry segments are also growing at a faster pace, this is primarily due to a surge in automobile sales with the advent of electric vehicles which requires optian cally clear adhesive market. For instance, as per the International Organization of Motor Vehicle Manufacturers (OICA) in 2019, around 67149196 units of passenger cars were sold around the globe. It created a massive demand for the OCA for providing lamination with transparent adhesive for the vehicles.

Global Optically Clear Adhesive Market Geographical Share

Asia-Pacific region holds the largest market share global optically clear adhesive market

Asia-Pacific region is dominating the global optically clear adhesive market and accounted for the largest market share in 2019, due to the presence of several manufacturing facilities of the consumer electronics, growing urban population with rising consumer spending as well as rising government support and initiative funding followed by North America and Europe.

As of 2019, China accounted for the highest share for consumer electronics manufacturing followed by India and Japan in the Asia-Pacific region. For instance, as per the India Brand Equity Foundation in 2019, the Indian appliance and consumer electronics (ACE) market reached around US$ 10.93 billion and is projected to grow by double to around US$ 21.18 billion by 2025 which is primarily due to rising consumer spending and surge in the internet penetration in this region which boost the sale and ultimately OCA market. Similarly, North America s also growing at a faster pace owing to the presence of advanced technology devices adoption and the rising launching of smart and wearable devices in this region followed by Europe.

Optically Clear Adhesive Market Companies and Competitive Landscape

The optically clear adhesive market is moderately competitive with the presence of local as well as global companies. Some of the key players which are contributing to the growth of the market include Hitachi Chemical, HB Fuller, Nitto, Dymax Corporation, 3M, Norland Products, Henkel, LG Chem, Tesa, Dymax Corporation, Masterbond, Delo Industrial Adhesives Ltd and among others.

The major players are adopting several growth strategies such as product launches, acquisitions and collaborations, which are contributing to the growth of the optically clear adhesive market globally. For instance, on 17th Aug 2020, Henkel Adhesive Technologies, one of the market leaders of high-impact adhesives, sealants and functional coatings solutions providers recently invested to establish a manufacturing facility for UV-curable acrylic pressure-sensitive adhesives (PSA) in Salisbury, North Carolina. Further on 4th Feb 2020, Henkel Adhesives Technology has invested around US$ 59 million (Rs 400 crores) for its new manufacturing facility in Kurkumbh near Pune.

- Methodology and Scope

- Research Methodology

- Research Objective and Scope of the Report

- Market Definition and Overview

- Executive Summary

- Market Snippet by Resin Type

- Market snippet by Thickness

- Market snippet by Substrate

- Market Snippet by Application

- Market Snippet by Region

- Market Dynamics

- Market Impacting Factors

- Drivers

- Growing sale of the consumers electronics such as mobile phones, tablets, computers, televisions with advent of E-commerce website

- Rising number sale of smart devices with surge in the use of E-commerce websites due to rising number of internet users around the globe

- Restraints:

- XX

- XX

- Opportunity

- Growing technological advancement around the globe as several leading players are launching novel electronic devices with considerably growing investment is to produce advanced product may create huge opportunity for this market

- Impact Analysis

- Industry Analysis

- Porter’s Five Forces Analysis

- Supply Chain Analysis

- Pricing Analysis

- Regulatory Analysis

- COVID-19 Analysis

- Analysis of Covid-19 on the Market

- Before COVID-19 Market Scenario

- Present COVID-19 Market Scenario

- After COVID-19 or Future Scenario

- Pricing Dynamics Amid Covid-19

- Demand-Supply Spectrum

- Government Initiatives Related to the Market During Pandemic

- Manufacturers Strategic Initiatives

- Conclusion

- Analysis of Covid-19 on the Market

- By Resin Type

- Introduction

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Resin Type Segment

- Market Attractiveness Index, By Resin Type Segment

- Acrylics*

- Introduction

- Market Size Analysis and Y-o-Y Growth Analysis (%)

- Polyvinyl Acetate

- Polyurethane

- Polypropylene

- Silicone

- Epoxy

- Others

- Introduction

- By Thickness

- Introduction

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- Market Attractiveness Index, By Thickness Segment

- Less Than 1MM*

- Introduction

- Market Size Analysis and Y-o-Y Growth Analysis (%)

- 1-2 MM

- 2-3 MM

- 3-4 MM

- 4-5 MM

- Others

- Introduction

- By Substrate

- Introduction

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Substrate

- Market Attractiveness Index, By Substrate Segment

- Metal*

- Introduction

- Market Size Analysis and Y-o-Y Growth Analysis (%)

- Glass and ITO Glass

- Polyethylene Terephthalate (PET)

- Polymethyl Methacrylate (PMMA)

- Polycarbonate (PC)

- Others

- Introduction

- By Application

- Introduction

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Application Segment

- Market Attractiveness Index, By Application Segment

- Mobile phones*

- Introduction

- Market Size Analysis and Y-o-Y Growth Analysis (%)

- Tablet

- Laptops and Monitors

- Televisions

- Outdoor signage

- Automotive

- Wearable Devices

- Electronic Blackboards

- Others

- Introduction

- By Region

- Introduction

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- Market Attractiveness Index, By Region

- North America

- Introduction

- Key Region-Specific Dynamics

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Resin Type

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Substrate

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- U.S.

- Canada

- Mexico

- Europe

- Introduction

- Key Region-Specific Dynamics

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Resin Type

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Substrate

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- Germany

- U.K.

- France

- Italy

- Spain

- Rest of Europe

- South America

- Introduction

- Key Region-Specific Dynamics

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Resin Type

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Substrate

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- Brazil

- Argentina

- Rest of South America

- Asia Pacific

- Introduction

- Key Region-Specific Dynamics

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Resin Type

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Substrate

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- China

- India

- Japan

- Australia

- Rest of Asia Pacific

- Middle East and Africa

- Introduction

- Key Region-Specific Dynamics

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Resin Type

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Substrate

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- Introduction

- Competitive Landscape

- Competitive Scenario

- Market Positioning/Share Analysis

- Mergers and Acquisitions Analysis

- Company Profiles

- Cummins Inc*

- Company Overview

- Forms Portfolio and Description

- Key Highlights

- Financial Overview

- Hitachi Chemical

- HB Fuller

- Nitto

- Dymax Corporation

- 3M

- Norland Products

- Henkel

- LG Chem

- Tesa

- Dymax Corporation

- Masterbond

- Delo Industrial Adhesives Ltd (List Not Exhaustive)

- Cummins Inc*

- DataM Intelligence

- Appendix

- About Us and Services

- Contact Us