| • レポートコード:IMA3303RW109 • 出版社/出版日:IMARC / 2025年3月 • レポート形態:英語、PDF、約100ページ • 納品方法:Eメール(納期:2日) • 産業分類:材料 |

| Single User | ¥455,848 (USD2,999) | ▷ お問い合わせ |

| Corporate User | ¥759,848 (USD4,999) | ▷ お問い合わせ |

• お支払方法:銀行振込(納品後、ご請求書送付)

レポート概要

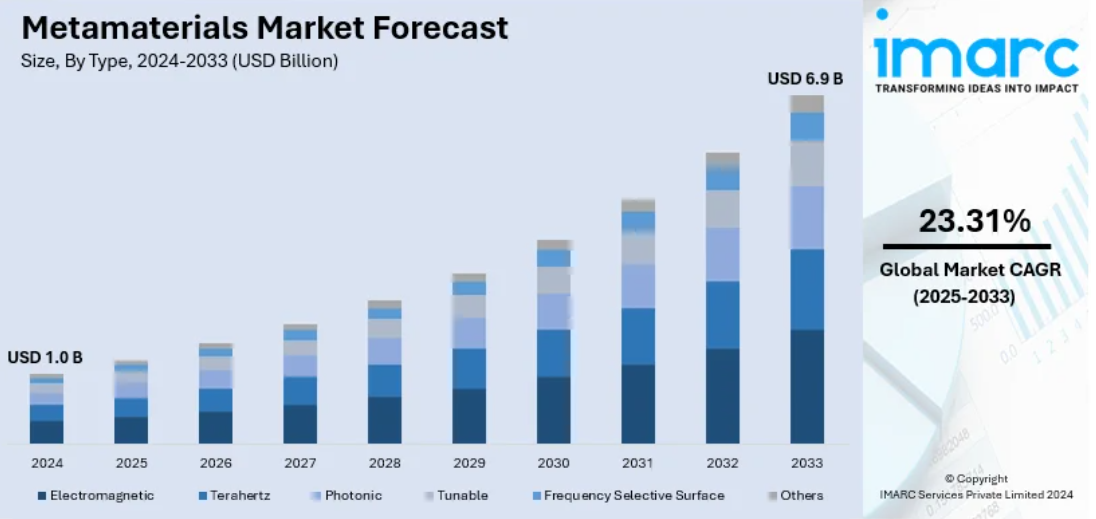

| 世界のメタマテリアル市場は2024年に10億米ドル規模で、2033年には69億米ドルに達すると予測され、2025~2033年の年平均成長率は23.31%と非常に高い成長が見込まれている。2024年時点で北米が42.2%超のシェアを占め、最大市場として業界を牽引している。市場成長の主因はナノテクノロジーやフォトニクスの技術革新、通信・防衛分野での需要増大、医療・再生可能エネルギーでの応用拡大、研究教育分野での取り組み、産業別カスタマイズ可能性の高さなどである。 メタマテリアルは電磁波操作能力の高さから通信、航空宇宙、防衛分野で急速に採用が進み、5G、レーダー、ステルス技術の進展を支えている。2024年9月にはグラスゴー大学が線偏波を円偏波に変換する0.64mm厚の2Dメタマテリアルを発表し、衛星通信やデータ信頼性の向上が期待されている。政府・民間によるR&D投資も増加し、医用画像診断、ウェアラブル、再エネ用途など多様な分野への展開が進む。米国市場では5Gインフラやレーダー需要、衛星通信投資が成長要因で、MITは音響メタマテリアルによる超音波制御技術を開発、医療・通信への応用を拡大している。再エネ分野では太陽光発電効率向上にも貢献し、産業横断的な重要性を高めている。 タイプ別では電磁メタマテリアルが約36.4%で最大セグメントを占め、マイクロ波や光の制御、光学レンズやクローク装置、通信システムに広く応用される。用途別ではアンテナ・レーダー分野が43.9%でトップで、より小型・広帯域・高効率な設計を可能にし、防衛・通信・航空宇宙分野の需要増に対応している。エンドユーザー別では航空宇宙・防衛が約29.7%で最大で、ステルス技術やレーダー断面低減など現代防衛戦略に不可欠な要素となっている。 地域別では北米がR&D投資と技術基盤の強さで優位を保ち、米国が市場の約89%を占める。欧州はエコ技術や医療分野での採用が進み、スマートシティや持続可能建築への応用も拡大中。アジア太平洋では半導体産業の成長と5G需要、EV開発が市場を押し上げており、中国は2030年までに世界半導体市場の成長の60%を担う見込み。南米ではブラジルを中心に再エネ分野、農業の精密化技術で需要が増加。中東・アフリカでは通信・防衛・スマートシティ開発が牽引している。 競争環境では各社がR&D強化、大学や研究機関との提携、M&Aや新拠点設立で新市場開拓を進めている。最新動向としてBASFによるフォトニック結晶メタマテリアル企業への出資、SamsungとMetalenzの協業による顔認証技術強化、Fractal Antennaのステルス検出技術特許、TeraViewの次世代IC検査装置発表、MetaShieldの防汚コーティング特許取得などがあり、用途と技術の多様化が進展している。 |

The global metamaterials market size was valued at USD 1.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.9 Billion by 2033, exhibiting a CAGR of 23.31% from 2025-2033. North America currently dominates the market, holding a market share of over 42.2% in 2024. The market is primarily driven by technological advancements in nanotechnology and photonics, increasing demand in wireless communication and defense sectors, expanding applications in healthcare and sustainable solutions, educational and research initiatives, and customization potential across various industries.

The metamaterials market is expanding due to increasing demand in telecommunications, aerospace, and defense. Their increasing ability to manipulate electromagnetic waves is driving advancements in technologies like 5G, radar, and stealth systems. On September 9, 2024, University of Glasgow engineers unveiled a 0.64mm-thick 2D metamaterial that converts linear to circular polarization, enhancing satellite communication and data reliability across Ku-, K-, and Ka-bands. Rising investments in research and development (R&D), supported by government and private funding, fuel continuous innovation. Additionally, their growing adoption in medical imaging, wearable devices, and renewable energy projects highlights their versatility. Moreover, lightweight, high-performance metamaterials are addressing complex technological challenges, solidifying their importance across diverse industries.

The United States is a key regional market and is expanding due to advancements in telecommunications, aerospace, and healthcare sectors. Demand for high-performance materials in 5G infrastructure, radar, and stealth technology drives growth, alongside rising investments in satellite communication. Metamaterials’ applications in medical imaging, such as MRI enhancements, further augment healthcare innovation. On November 20, 2024, MIT researchers advanced ultrasound wave control in microscale acoustic metamaterials, enabling devices like acoustic demultiplexers for medical and communication uses. Their framework links geometry to material properties, improving fabrication methods. Additionally, metamaterials play a growing role in renewable energy solutions, enhancing solar panel efficiency and energy harvesting. These developments, supported by government and industry collaboration, solidify the United States’ leadership in metamaterial innovation.

Metamaterials Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global metamaterials market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end user.

Analysis by Type:

Electromagnetic

Terahertz

Photonic

Tunable

Frequency Selective Surface

Others

Analysis by Application:

Antenna and Radar

Cloaking Devices

Super Lens

Others

Analysis by End User:

Aerospace and Defense

Medical

Automotive

Consumer Electronics

Energy and Power

Others

Regional Analysis:

North America

United States

Canada

Asia-Pacific

China

Japan

India

South Korea

Australia

Indonesia

Others

Europe

Germany

France

United Kingdom

Italy

Spain

Russia

Others

Latin America

Brazil

Mexico

Others

Middle East and Africa

1 Preface

2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Metamaterials Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Type

6.1 Electromagnetic

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Terahertz

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Photonic

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Tunable

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Frequency Selective Surface

6.5.1 Market Trends

6.5.2 Market Forecast

6.6 Others

6.6.1 Market Trends

6.6.2 Market Forecast

7 Market Breakup by Application

7.1 Absorber

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Antenna and Radar

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Cloaking Devices

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Super Lens

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Others

7.5.1 Market Trends

7.5.2 Market Forecast

8 Market Breakup by End User

8.1 Aerospace and Defense

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Medical

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Automotive

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Consumer Electronics

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Energy and Power

8.5.1 Market Trends

8.5.2 Market Forecast

8.6 Others

8.6.1 Market Trends

8.6.2 Market Forecast

9 Market Breakup by Region

9.1 North America

9.1.1 United States

9.1.1.1 Market Trends

9.1.1.2 Market Forecast

9.1.2 Canada

9.1.2.1 Market Trends

9.1.2.2 Market Forecast

9.2 Asia-Pacific

9.2.1 China

9.2.1.1 Market Trends

9.2.1.2 Market Forecast

9.2.2 Japan

9.2.2.1 Market Trends

9.2.2.2 Market Forecast

9.2.3 India

9.2.3.1 Market Trends

9.2.3.2 Market Forecast

9.2.4 South Korea

9.2.4.1 Market Trends

9.2.4.2 Market Forecast

9.2.5 Australia

9.2.5.1 Market Trends

9.2.5.2 Market Forecast

9.2.6 Indonesia

9.2.6.1 Market Trends

9.2.6.2 Market Forecast

9.2.7 Others

9.2.7.1 Market Trends

9.2.7.2 Market Forecast

9.3 Europe

9.3.1 Germany

9.3.1.1 Market Trends

9.3.1.2 Market Forecast

9.3.2 France

9.3.2.1 Market Trends

9.3.2.2 Market Forecast

9.3.3 United Kingdom

9.3.3.1 Market Trends

9.3.3.2 Market Forecast

9.3.4 Italy

9.3.4.1 Market Trends

9.3.4.2 Market Forecast

9.3.5 Spain

9.3.5.1 Market Trends

9.3.5.2 Market Forecast

9.3.6 Russia

9.3.6.1 Market Trends

9.3.6.2 Market Forecast

9.3.7 Others

9.3.7.1 Market Trends

9.3.7.2 Market Forecast

9.4 Latin America

9.4.1 Brazil

9.4.1.1 Market Trends

9.4.1.2 Market Forecast

9.4.2 Mexico

9.4.2.1 Market Trends

9.4.2.2 Market Forecast

9.4.3 Others

9.4.3.1 Market Trends

9.4.3.2 Market Forecast

9.5 Middle East and Africa

9.5.1 Market Trends

9.5.2 Market Breakup by Country

9.5.3 Market Forecast

10 SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 Acoustic Metamaterials Group Ltd

14.3.1.1 Company Overview

14.3.1.2 Product Portfolio

14.3.2 Echodyne Corp

14.3.2.1 Company Overview

14.3.2.2 Product Portfolio

14.3.3 Fractal Antenna Systems Inc.

14.3.3.1 Company Overview

14.3.3.2 Product Portfolio

14.3.4 JEM Engineering LLC

14.3.4.1 Company Overview

14.3.4.2 Product Portfolio

14.3.5 Kymeta Corporation

14.3.5.1 Company Overview

14.3.5.2 Product Portfolio

14.3.6 Metamagnetics Inc

14.3.6.1 Company Overview

14.3.6.2 Product Portfolio

14.3.7 Metamaterial Technologies Inc.

14.3.7.1 Company Overview

14.3.7.2 Product Portfolio

14.3.8 MetaShield LLC

14.3.8.1 Company Overview

14.3.8.2 Product Portfolio

14.3.9 Nanoscribe GmbH & Co. KG (Cellink AB)

14.3.9.1 Company Overview

14.3.9.2 Product Portfolio

14.3.10 Plasmonics Inc.

14.3.10.1 Company Overview

14.3.10.2 Product Portfolio

14.3.11 TeraView Limited

14.3.11.1 Company Overview

14.3.11.2 Product Portfolio

List of Figures

Figure 1: Global: Metamaterials Market: Major Drivers and Challenges

Figure 2: Global: Metamaterials Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Metamaterials Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 4: Global: Metamaterials Market: Breakup by Type (in %), 2024

Figure 5: Global: Metamaterials Market: Breakup by Application (in %), 2024

Figure 6: Global: Metamaterials Market: Breakup by End User (in %), 2024

Figure 7: Global: Metamaterials Market: Breakup by Region (in %), 2024

Figure 8: Global: Metamaterials (Electromagnetic) Market: Sales Value (in Million USD), 2019 & 2024

Figure 9: Global: Metamaterials (Electromagnetic) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 10: Global: Metamaterials (Terahertz) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Metamaterials (Terahertz) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Metamaterials (Photonic) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Metamaterials (Photonic) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Metamaterials (Tunable) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Metamaterials (Tunable) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Metamaterials (Frequency Selective Surface) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Metamaterials (Frequency Selective Surface) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Metamaterials (Other Types) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Metamaterials (Other Types) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Metamaterials (Absorber) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Metamaterials (Absorber) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Metamaterials (Antenna and Radar) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Metamaterials (Antenna and Radar) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Metamaterials (Cloaking Devices) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Metamaterials (Cloaking Devices) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Metamaterials (Super Lens) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Metamaterials (Super Lens) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Metamaterials (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Metamaterials (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Metamaterials (Aerospace and Defense) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Metamaterials (Aerospace and Defense) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Metamaterials (Medical) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Metamaterials (Medical) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Metamaterials (Automotive) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Metamaterials (Automotive) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Global: Metamaterials (Consumer Electronics) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Global: Metamaterials (Consumer Electronics) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Global: Metamaterials (Energy and Power) Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Global: Metamaterials (Energy and Power) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: Global: Metamaterials (Other End Users) Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: Global: Metamaterials (Other End Users) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: North America: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: North America: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: United States: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: United States: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: Canada: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: Canada: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: Asia-Pacific: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: Asia-Pacific: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: China: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: China: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: Japan: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: Japan: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: India: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: India: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: South Korea: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: South Korea: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: Australia: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: Australia: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: Indonesia: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: Indonesia: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: Others: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: Others: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: Europe: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: Europe: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: Germany: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: Germany: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: France: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: France: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: United Kingdom: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: United Kingdom: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: Italy: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: Italy: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Spain: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Spain: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Russia: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Russia: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Others: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: Others: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: Latin America: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: Latin America: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: Brazil: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 83: Brazil: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 84: Mexico: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 85: Mexico: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 86: Others: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 87: Others: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 88: Middle East and Africa: Metamaterials Market: Sales Value (in Million USD), 2019 & 2024

Figure 89: Middle East and Africa: Metamaterials Market: Breakup by Country (in %), 2024

Figure 90: Middle East and Africa: Metamaterials Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 91: Global: Metamaterials Industry: SWOT Analysis

Figure 92: Global: Metamaterials Industry: Value Chain Analysis

Figure 93: Global: Metamaterials Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: Metamaterials Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Metamaterials Market Forecast: Breakup by Type (in Million USD), 2025-2033

Table 3: Global: Metamaterials Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 4: Global: Metamaterials Market Forecast: Breakup by End User (in Million USD), 2025-2033

Table 5: Global: Metamaterials Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 6: Global: Metamaterials Market: Competitive Structure

Table 7: Global: Metamaterials Market: Key Players