| • レポートコード:IMA222JN6002 • 出版社/出版日:IMARC / 2025年3月 • レポート形態:英語、PDF、約120ページ • 納品方法:Eメール(納期:2日) • 産業分類:材料 |

| Single User | ¥455,848 (USD2,999) | ▷ お問い合わせ |

| Corporate User | ¥759,848 (USD4,999) | ▷ お問い合わせ |

• お支払方法:銀行振込(納品後、ご請求書送付)

レポート概要

| 世界の不織布市場は2024年に477億米ドル規模に達し、2025~2033年に年平均約5.2%で成長し、2033年には753億米ドルに到達すると予測されている。主因は医療・衛生分野における需要拡大であり、マスク、ガウン、衛生用品などの使い捨て製品が不可欠であることが背景にある。加えて、ウェットティッシュや紙おむつなどパーソナルケア製品の利用増加も市場拡大を後押ししている。自動車分野では吸音材、断熱材、フィルター、内装材としての採用が進んでおり、軽量性と機能性を両立する材料としての重要性が高まっている。環境対応型素材やリサイクル技術の進展も市場成長の大きな推進力となっている。 市場環境として、COVID-19を契機に医療用不織布の需要が急増し、その後も衛生意識の高まりが継続している。医療機関では感染防止と使い捨て製品の利用増加が進み、特に高いろ過性能と通気性、コスト効率を備えた不織布が重視される傾向にある。また、新興国を中心に衛生意識が向上しており、衛生用品や医療用不織布の採用が加速している。 パーソナルケア領域では、2023年に5,062億米ドル規模の美容・パーソナルケア市場が2024~2032年に年平均4.5%で拡大すると見込まれ、柔らかさと肌ざわりに優れる不織布の需要が増大している。政府による衛生改善政策も普及を促進している。自動車分野ではインドを中心とした生産拡大や輸出増加が市場を押し上げ、環境対応とコスト効率を兼ね備えた軽量素材として不織布の採用が一段と進むと見られる。 素材別ではポリプロピレンが最大シェアで、コスト効率、加工性、耐薬品性、リサイクル適性により衛生・医療用途を中心に需要が拡大している。製法別ではスパンボンド法が主流で、耐久性、軽量性、通気性に優れ、衛生・医療品、包装用途などで広く採用される。用途別ではパーソナルケア・衛生分野が最大で、人口増加や高齢化、衛生意識の向上により成長が続く見通しである。地域別ではアジア太平洋が人口規模と産業基盤の優位性から最大市場となり、欧州・北米はヘルスケアと自動車産業が成長を支える。環境規制や原材料価格の上昇が課題となる一方、サステナブル素材開発が新たな成長機会となる。 |

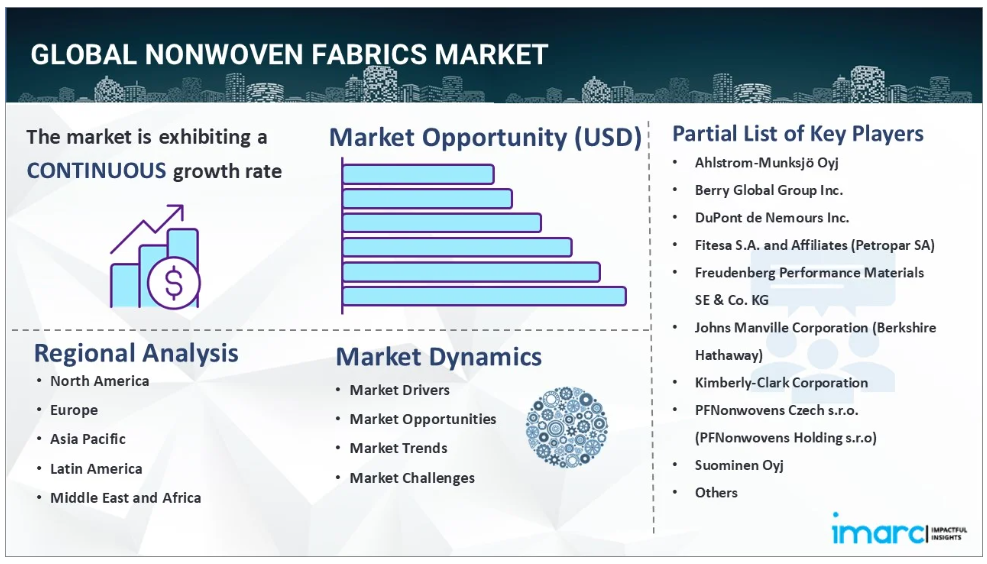

The global nonwoven fabrics market size reached USD 47.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 75.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.2% during 2025-2033. The market is witnessing strong growth because of heightening demand in healthcare and hygienic sectors, where items, such as surgical masks, gowns, and sanitary products are a necessity. Personal care products, including wipes and diapers, are also driving market growth. The automotive sector is using more nonwoven fabrics for insulation, filtration, and interior parts. Innovations in technology and sustainability trends are driving manufacturers towards environmentally friendly and affordable solutions, substantially impacting the nonwoven fabrics market share.

Nonwoven Fabrics Market Analysis:

• Major Market Drivers: The need for nonwoven textiles is rising owing to the construction, automotive, and healthcare sectors growth. Furthermore, the growing demand for medical items, particularly during and after COVID-19, and improved awareness about cleanliness have greatly increased product demand.

• Key Market Trends: The industry is shaped by technological developments in production processes, such as automation and the use of recycled materials. In line with international environmental initiatives, the increasing need for eco-friendly and sustainable nonwoven textiles are major trends propelling the market growth.

• Geographical Trends: Asia-Pacific nonwoven textiles market is driven by high population density, increasing industrialization, and robust production facilities. Besides, Europe and North America are driven by automotive and healthcare industries significant growth.

• Competitive Landscape: Some of the leading nonwoven fabrics companies include Ahlstrom-Munksjö Oyj, Berry Global Group Inc., DuPont de Nemours Inc., Fitesa S.A. and Affiliates (Petropar SA), Freudenberg Performance Materials SE & Co. KG, Johns Manville Corporation (Berkshire Hathaway), Kimberly-Clark Corporation, PFNonwovens Czech s.r.o. (PFNonwovens Holding s.r.o), Suominen Oyj, Toray Industries Inc., and TWE GmbH & Co. KG., among many others.

• Challenges and Opportunities: The market is faced with challenges from strict environmental rules and growing raw material costs. On the other hand, the growing consumer demand for eco-friendly goods and advancements in production methods represent vast opportunities for companies to increase their market share.

Nonwoven Fabrics Market Trends:

Rising Demand from Healthcare and Hygiene Sectors

The market for nonwoven textiles is expanding due to the rise of the hygiene and healthcare industries. In addition, the need for disposable medical supplies including masks, gowns, and surgical drapes surged globally, particularly during the epidemic. The American Medical Association reports that in 2022, US health spending reached $4.5 Trillion, or $13,493 per person, an increase of 4.1%. Additionally, health spending made up 17.3% of the nation’s GDP in 2022. Moreover, the demand for medical-grade masks and personal protective equipment has grown due to the recent rapid expansion, which has resulted in a significant increase in the use of nonwoven materials. As healthcare systems across the globe continue to focus on preventing infections and ensuring patient safety, nonwoven fabrics have become essential due to their high filtration efficiency, breathability, and cost-effectiveness. Besides, healthcare facilities are increasingly focusing on infection control and single-use products, and the trend of disposable items in healthcare environments, motivated by hygiene and cross-contamination issues, has further widened the market and will continue to shape healthcare sectors post-pandemic. Furthermore, the increasing awareness regarding personal hygiene in developing economies is increasing the adoption of nonwoven medical products, thus propelling nonwoven fabrics market growth on a global scale.

Growth in Personal Care Products

The growing demand for personal care products is influencing the nonwoven fabrics market. According to the IMARC Group, the global market for beauty and personal care products reached a value of US$ 506.2 Billion in 2023. The market is projected to grow to US$ 759.3 Billion by 2032, with an expected CAGR of 4.5% between 2024 and 2032. Additionally, the increasing awareness about health and hygiene is escalating the nonwoven fabrics demand as nonwovens are soft and gentle on the skin, making them ideal for products like baby diapers, feminine hygiene products, and adult incontinence items. Their texture helps provide comfort during prolonged use. Furthermore, government initiatives promoting hygiene standards and better living conditions are driving the adoption of nonwoven fabrics in various personal care applications.

Significant Expansion in the Automotive Industry

According to the India Brand Equity Foundation (IBEF), Indian market captures the third position in the international market for heavy vehicles. India is the largest tractor manufacturer and second-largest bus manufacturer and third-largest heavy truck maker. For the fiscal year of 2023, India produced 25.9 million vehicles. The economy of the country is supported by healthy internal demand coupled with large export volumes. Passenger vehicles, three-wheelers, two-wheelers, and quadricycles have collectively managed to achieve a production output of 2,358,041 units as of April 2024. Besides, India’s total vehicle exports for the fiscal year 2023 were 4,761,487 units. Another important factor that drives the market is the growing usage of nonwoven fabrics by the automotive sector for applications such as insulation, filtration, and upholstery. These materials are lightweight, strong, and possess good thermal and acoustic insulation properties, making them more suitable for the interior of automobiles. Since car manufacturers are always on the lookout for sustainable materials that are offered at minimal costs, nonwoven textiles will be more recurrent in the future of car production, thus creating a positive nonwoven fabrics market outlook.

Nonwoven Fabrics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on material type, technology and application.

Breakup by Material Type:

• Polyester

• Polypropylene

• Polyethylene

• Rayon

• Others

Polypropylene accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the material type. This includes polyester, polypropylene, polyethylene, rayon, and others. According to the report, polypropylene represented the largest segment.

The report for the nonwoven fabrics market reveals that polypropylene is the fastest-growing segment and is gaining the lead owing to the rising demand. It is cost-effective and versatile in use for numerous applications. It is commonly employed in hygiene products such as diapers, sanitary napkins, and medical supplies like masks and gowns, with several industrial applications. Its lightweight and durable properties are essential for producing high-quality, disposable nonwoven fabrics. Moreover, the rising demand due to polypropylene’s chemical resistance and eco-friendly recycling options are influencing the market growth. As the requirements for sustainable disposable products increase, polypropylene continues to generate a favorable nonwoven fabrics market revenue.

Breakup by Technology:

• Spun Bond

• Wet Laid

• Dry Laid

• Others

Spun bond holds the largest share of the industry

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes spun bond, wet laid, dry laid, and others. According to the report, spun bond accounted for the largest market share.

Spun bond technology holds the largest market share owing to its versatility, affordability, and various uses. Additionally, spun bond nonwovens are produced by extruding filaments that are laid into a web and then bonded, creating durable, lightweight, and breathable fabrics. Spun bond fabrics are ideal for use in packaging, medical textiles, and hygiene goods owing to their value. Hence, major firms are launching sophisticated product variations to address these demands. As per the nonwoven fabrics market recent opportunities, on 28 August 2024, Welspun Living, a division of the Welspun Group known for its leadership in Environmental, Social, and Governance (ESG) initiatives, entered into a strategic alliance with Avgol Industries. This partnership aims to promote sustainable practices within the nonwoven fabric sector. Avgol, recognized for its expertise in high-performance spun-melt nonwoven fabrics, is part of Indorama Ventures Group, which collaborates exclusively with Polymateria. Polymateria is a UK-based tech firm renowned for pioneering biodegradable alternatives to traditional plastics.

Breakup by Application:

• Personal Care and Hygiene

• Filtration

• Healthcare

• Automotive

• Building and Construction

• Others

Personal care and hygiene represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes personal care and hygiene, filtration, healthcare, automotive, building and construction, and others. According to the report, personal care and hygiene represented the largest segment.

Personal care and hygiene hold the largest market share due to the extensive use of nonwoven materials in products like diapers, feminine hygiene products, and adult incontinence items. Additionally, the growing awareness about personal hygiene, especially in developing regions, along with rising birth rates and an aging population are escalating the demand for these products. Moreover, the nonwoven fabrics market forecast highlights continued growth due to increasing preference for disposable, eco-friendly hygiene products, which increased the need for nonwoven fabrics in this segment. For instance, on 1 November 2023, WPT Nonwovens was thrilled to participate in Hygienix 2023, scheduled for November 13 to 16 in New Orleans, Louisiana. The event is hosted by the Association of the Nonwoven Fabrics Industry (INDA) and Cotton Incorporated. Additionally, hygienix offers unparalleled opportunities for networking and education, as the premier event for the absorbent hygiene and personal care industries.

Breakup by Region:

• North America

o United States

o Canada

• Asia Pacific

o China

o Japan

o India

o South Korea

o Australia

o Indonesia

o Others

• Europe

o Germany

o France

o United Kingdom

o Italy

o Spain

o Russia

o Others

• Latin America

o Brazil

o Mexico

o Others

• Middle East and Africa

1 Preface

2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Nonwoven Fabrics Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Material Type

6.1 Polyester

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Polypropylene

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Polyethylene

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Rayon

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Others

6.5.1 Market Trends

6.5.2 Market Forecast

7 Market Breakup by Technology

7.1 Spun Bond

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Wet Laid

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Dry Laid

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Others

7.4.1 Market Trends

7.4.2 Market Forecast

8 Market Breakup by Application

8.1 Personal Care and Hygiene

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Filtration

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Healthcare

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Automotive

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Building and Construction

8.5.1 Market Trends

8.5.2 Market Forecast

8.6 Others

8.6.1 Market Trends

8.6.2 Market Forecast

9 Market Breakup by Region

9.1 North America

9.1.1 United States

9.1.1.1 Market Trends

9.1.1.2 Market Forecast

9.1.2 Canada

9.1.2.1 Market Trends

9.1.2.2 Market Forecast

9.2 Asia Pacific

9.2.1 China

9.2.1.1 Market Trends

9.2.1.2 Market Forecast

9.2.2 Japan

9.2.2.1 Market Trends

9.2.2.2 Market Forecast

9.2.3 India

9.2.3.1 Market Trends

9.2.3.2 Market Forecast

9.2.4 South Korea

9.2.4.1 Market Trends

9.2.4.2 Market Forecast

9.2.5 Australia

9.2.5.1 Market Trends

9.2.5.2 Market Forecast

9.2.6 Indonesia

9.2.6.1 Market Trends

9.2.6.2 Market Forecast

9.2.7 Others

9.2.7.1 Market Trends

9.2.7.2 Market Forecast

9.3 Europe

9.3.1 Germany

9.3.1.1 Market Trends

9.3.1.2 Market Forecast

9.3.2 France

9.3.2.1 Market Trends

9.3.2.2 Market Forecast

9.3.3 United Kingdom

9.3.3.1 Market Trends

9.3.3.2 Market Forecast

9.3.4 Italy

9.3.4.1 Market Trends

9.3.4.2 Market Forecast

9.3.5 Spain

9.3.5.1 Market Trends

9.3.5.2 Market Forecast

9.3.6 Russia

9.3.6.1 Market Trends

9.3.6.2 Market Forecast

9.3.7 Others

9.3.7.1 Market Trends

9.3.7.2 Market Forecast

9.4 Latin America

9.4.1 Brazil

9.4.1.1 Market Trends

9.4.1.2 Market Forecast

9.4.2 Mexico

9.4.2.1 Market Trends

9.4.2.2 Market Forecast

9.4.3 Others

9.4.3.1 Market Trends

9.4.3.2 Market Forecast

9.5 Middle East and Africa

9.5.1 Market Trends

9.5.2 Market Breakup by Country

9.5.3 Market Forecast

10 SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 Ahlstrom-Munksjö Oyj

14.3.1.1 Company Overview

14.3.1.2 Product Portfolio

14.3.1.3 Financials

14.3.2 Berry Global Group Inc.

14.3.2.1 Company Overview

14.3.2.2 Product Portfolio

14.3.2.3 Financials

14.3.2.4 SWOT Analysis

14.3.3 DuPont de Nemours Inc

14.3.3.1 Company Overview

14.3.3.2 Product Portfolio

14.3.3.3 Financials

14.3.4 Fitesa S.A. and Affiliates (Petropar SA)

14.3.4.1 Company Overview

14.3.4.2 Product Portfolio

14.3.5 Freudenberg Performance Materials SE & Co. KG

14.3.5.1 Company Overview

14.3.5.2 Product Portfolio

14.3.6 Johns Manville Corporation (Berkshire Hathaway)

14.3.6.1 Company Overview

14.3.6.2 Product Portfolio

14.3.7 Kimberly-Clark Corporation

14.3.7.1 Company Overview

14.3.7.2 Product Portfolio

14.3.7.3 Financials

14.3.7.4 SWOT Analysis

14.3.8 PFNonwovens Czech s.r.o. (PFNonwovens Holding s.r.o)

14.3.8.1 Company Overview

14.3.8.2 Product Portfolio

14.3.9 Suominen Oyj

14.3.9.1 Company Overview

14.3.9.2 Product Portfolio

14.3.9.3 Financials

14.3.10 Toray Industries Inc.

14.3.10.1 Company Overview

14.3.10.2 Product Portfolio

14.3.10.3 Financials

14.3.10.4 SWOT Analysis

14.3.11 TWE GmbH & Co. KG

14.3.11.1 Company Overview

14.3.11.2 Product Portfolio

14.3.11.3 Financials

List of Figures

Figure 1: Global: Nonwoven Fabrics Market: Major Drivers and Challenges

Figure 2: Global: Nonwoven Fabrics Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Nonwoven Fabrics Market: Breakup by Material Type (in %), 2024

Figure 4: Global: Nonwoven Fabrics Market: Breakup by Technology (in %), 2024

Figure 5: Global: Nonwoven Fabrics Market: Breakup by Application (in %), 2024

Figure 6: Global: Nonwoven Fabrics Market: Breakup by Region (in %), 2024

Figure 7: Global: Nonwoven Fabrics Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 8: Global: Nonwoven Fabrics (Polyester) Market: Sales Value (in Million USD), 2019 & 2024

Figure 9: Global: Nonwoven Fabrics (Polyester) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 10: Global: Nonwoven Fabrics (Polypropylene) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11 Global: Nonwoven Fabrics (Polypropylene) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Nonwoven Fabrics (Polyethylene) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Nonwoven Fabrics (Polyethylene) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Nonwoven Fabrics (Rayon) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Nonwoven Fabrics (Rayon) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Nonwoven Fabrics (Other Material Types) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Nonwoven Fabrics (Other Material Types) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Nonwoven Fabrics (Spun Bond) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Nonwoven Fabrics (Spun Bond) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Nonwoven Fabrics (Wet Laid) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Nonwoven Fabrics (Wet Laid) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Nonwoven Fabrics (Dry Laid) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Nonwoven Fabrics (Dry Laid) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Nonwoven Fabrics (Other Technologies) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Nonwoven Fabrics (Other Technologies) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Nonwoven Fabrics (Personal Care and Hygiene) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Nonwoven Fabrics (Personal Care and Hygiene) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Nonwoven Fabrics (Filtration) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Nonwoven Fabrics (Filtration) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Nonwoven Fabrics (Healthcare) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Nonwoven Fabrics (Healthcare) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Nonwoven Fabrics (Automotive) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Nonwoven Fabrics (Automotive) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Nonwoven Fabrics (Building and Construction) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Nonwoven Fabrics (Building and Construction) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Global: Nonwoven Fabrics (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Global: Nonwoven Fabrics (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: North America: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: North America: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: United States: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: United States: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: Canada: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: Canada: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: Asia Pacific: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: Asia Pacific: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: China: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: China: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: Japan: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: Japan: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: India: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: India: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: South Korea: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: South Korea: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: Australia: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: Australia: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: Indonesia: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: Indonesia: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: Others: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: Others: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: Europe: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: Europe: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: Germany: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: Germany: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: France: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: France: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: United Kingdom: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: United Kingdom: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: Italy: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: Italy: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: Spain: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: Spain: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: Russia: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: Russia: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Others: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Others: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Latin America: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Latin America: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Brazil: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: Brazil: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: Mexico: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: Mexico: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: Others: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 83: Others: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 84: Middle East and Africa: Nonwoven Fabrics Market: Sales Value (in Million USD), 2019 & 2024

Figure 85: Middle East and Africa: Nonwoven Fabrics Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 86: Global: Nonwoven Fabrics Industry: SWOT Analysis

Figure 87: Global: Nonwoven Fabrics Industry: Value Chain Analysis

Figure 88: Global: Nonwoven Fabrics Industry: Porter’s Five Forces Analysis