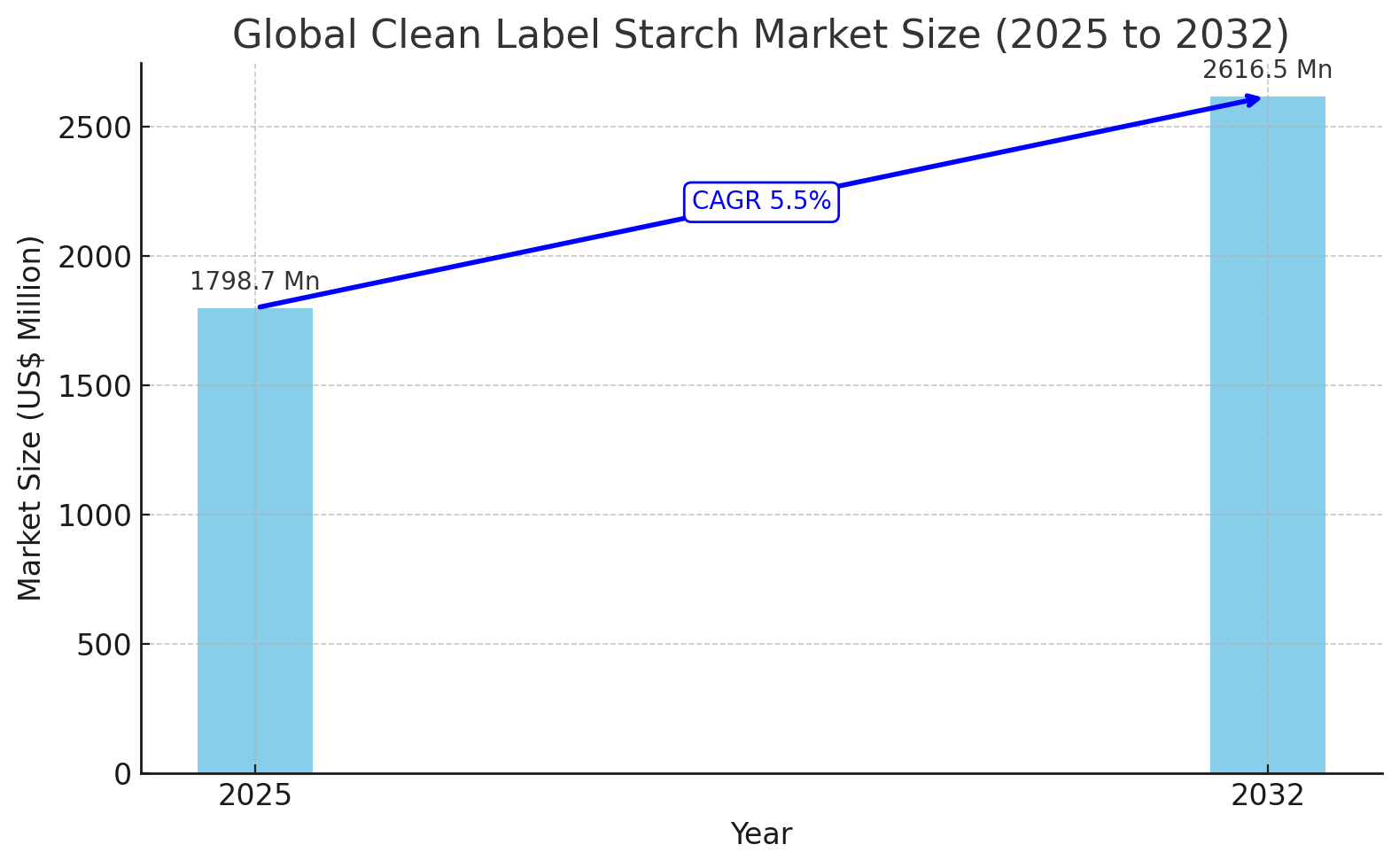

The global clean label starch market is poised to expand steadily over the forecast period. In 2025, the market is estimated to reach a value of USD 1,798.7 million, and it is projected to grow at a compound annual growth rate (CAGR) of 5.5%, reaching approximately USD 2,616.5 million by 2032. This growth is being driven by evolving consumer preferences, an increasing demand for natural and plant-based ingredients, and heightened awareness of food labeling transparency.

From 2019 to 2024, the market experienced moderate growth at a CAGR of 3.8%, reaching a value of approximately USD 1,732.9 million by 2024. Rising demand for clean-label functional food additives and a shift away from artificial and synthetic components have played a key role in this growth. Consumers across regions are placing a stronger emphasis on wellness and transparency, often prioritizing ingredient labels over brand loyalty. This behavior has created opportunities for manufacturers to innovate and diversify their product offerings using label-friendly starches derived from corn, potato, tapioca, and other natural sources.

Food manufacturers are responding to these preferences by reformulating existing products and introducing new ones that align with clean label standards. As urbanization increases and lifestyles become busier, particularly in developing regions, the need for convenient, processed, and ready-to-eat foods continues to grow. Clean label starch is now a critical component in such products due to its ability to deliver desirable texture and stability without compromising health or ingredient clarity.

One of the most significant trends in the market is the increasing demand for natural, plant-based ingredients. Consumers are increasingly concerned about the long-term impact of artificial additives and are seeking out healthier options, especially in categories like soups, sauces, dairy, and baked goods. Clean label starches are playing a vital role in this transition by acting as thickeners, stabilizers, and binding agents in these applications.

In 2024, soups and sauces accounted for the largest application segment, contributing to 44% of clean label starch use. The health benefits associated with starches like corn and tapioca—such as improved blood glucose control, cardiovascular support, and gut health—are driving this demand. Clean label starches are also suitable for low pH and high-shear processing environments, making them particularly useful in industrial food production.

The food additive industry’s rapid evolution is another key growth driver. Consumers, especially younger demographics, are more inclined toward natural and ethical ingredients. As the industry moves away from synthetic additives, demand for starches with clean label certifications continues to rise. These starches also contribute to longer shelf life and improved quality in a variety of processed foods including meat, desserts, and dairy products.

The market is highly dynamic, with companies implementing strategies to expand product visibility across regions. Many manufacturers are investing in innovation and regional partnerships to strengthen their positions. For example, in January 2020, AGRANA Beteiligungs-AG acquired Marroquin Organic International to bolster its starch distribution capabilities. Similarly, Archer Daniels Midland Company formed a strategic alliance with Thailand-based General Starch Limited to expand access to tapioca starch in the Asia-Pacific region.

Europe remains one of the most significant markets for clean label starch, with the United Kingdom accounting for 14.9% of regional market share in 2024. The demand in Europe is largely fueled by the region’s strict food regulations and consumer inclination toward clean and functional additives that enhance taste and texture without artificial elements.

India is emerging as a key market in Asia, with clean label starch demand valued at USD 111.2 million in 2024. The Indian market is expected to grow at a volume CAGR of 8.8% during the forecast period, driven by increasing awareness of chemical-free ingredients and rising health consciousness among consumers.

By source, corn starch dominates the global clean label starch market with a 52.2% share. This is primarily attributed to its compatibility with various food products and its popularity among consumers who are adopting healthier diets. Wheat, potato, tapioca, rice, and pea starches also account for significant shares in global usage, with applications ranging from snacks and bakery products to beverages and infant formulas.

In addition to food, clean label starch is gaining traction in the pharmaceutical industry. The market value of clean label starch in this segment is projected to reach USD 114.5 million by 2032. It is being increasingly utilized in medicine formulation, offering health benefits and improved digestibility. Consumers are also leaning toward fiber-rich, low-fat meals, which enhances the demand for clean starches in therapeutic and nutritional applications.

Leading companies are actively investing in product development and infrastructure to meet growing global demand. AGRANA Beteiligungs-AG invested over USD 34.4 million in its Austrian plant to scale up potato and corn starch production. Ingredion Incorporated introduced NOVATION 3620 and 3820 for beverages, while Tate & Lyle added new formulations suited for frozen meals, sauces, and yogurts. Roquette Frères S.A launched Lycagel, a pea-based alternative to gelatin for softgel capsules, expanding the clean label concept into pharmaceutical and nutraceutical applications.

The competitive landscape includes major global players such as Ingredion Incorporated, Cargill, Tate & Lyle, ADM, AGRANA, Roquette, BENEO, and Avebe. These companies are focused on R&D, sustainability, and strategic expansion into high-growth markets such as South Asia, East Asia, and the Middle East. Innovation and local partnerships are key themes in this evolving sector.

Overall, the clean label starch market is expected to continue growing as consumer preferences shift toward transparency, health-conscious diets, and sustainable sourcing. Manufacturers that prioritize product integrity and align with clean label standards are well-positioned to benefit from this global movement toward better food and health.

Clean Label Starch Industry Research by Category

By Source:

- Corn

- Wheat

- Potato

- Tapioca

- Rice & Pea

By Form:

- Powder

- Liquid

By Application:

- Food Industry

- Dairy Products

- Bakery

- Soups, Sauces & Dressings

- Infant Formula

- Convenience Foods

- Snacks & Confectionery

- Beverages

- Others

- Animal Feed Industry

- Pharmaceutical

- Others

By Region:

- North America

- Latin America

- Europe

- South Asia & Pacific

- East Asia

- Middle East & Africa

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Technology Roadmap

1.5. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation / Development Trends

4. Key Success Factors

4.1. Product Adoption / Usage Analysis

4.2. Product USPs / Features

4.3. Product Differentiation and Brand’s Strategy Analysis

5. Global Clean Label Starch Market Demand Analysis 2019-2032

5.1. Historical Market Volume (Tons) Analysis, 2019-2023

5.2. Current and Future Market Volume (Tons) Projections, 2024-2032

5.3. Y-o-Y Growth Trend Analysis

6. Global Clean Label Starch Market – Pricing Analysis

6.1. Regional Pricing Trend Analysis

6.2. Global Average Pricing Analysis Benchmark

7. Global Clean Label Starch Market Demand (in Value or Size in US$ Mn) Analysis 2019-2032

7.1. Historical Market Value (US$ Mn) Analysis, 2019-2023

7.2. Current and Future Market Value (US$ Mn) Projections, 2024-2032

7.2.1. Y-o-Y Growth Trend Analysis

7.2.2. Absolute $ Opportunity Analysis

8. Market Background

8.1. Macro-Economic Factors

8.1.1. Global GDP Growth Outlook

8.1.2. Global Food Industry Overview

8.1.3. Global GDP and Infrastructure Investment

8.1.4. International Trade

8.1.5. Global Industry Outlook

8.2. Forecast Factors – Relevance & Impact

8.2.1. Top Companies Historical Growth

8.2.2. GDP Growth forecast

8.2.3. Manufacturing Industry forecast

8.2.4. Business Climate

8.3. Value Chain

8.3.1. Raw Material Suppliers

8.3.2. Product Manufacturers

8.3.3. Applicationrs

8.4. Global Food Industry Outlook

8.5. Market Dynamics

8.5.1. Drivers

8.5.2. Restraints

8.5.3. Opportunity Analysis

8.6. Global Supply Demand Analysis

9. Global Clean Label Starch Market Analysis 2019-2032, By Form

9.1. Introduction / Key Findings

9.2. Historical Market Size (US$ Mn) and Volume Analysis By Form, 2019-2023

9.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Form, 2024-2032

9.3.1. Liquid

9.3.2. Powder

9.4. Market Attractiveness Analysis By Form

10. Global Clean Label Starch Market Analysis 2019-2032, by Source

10.1. Introduction / Key Findings

10.2. Historical Market Size (US$ Mn) and Volume Analysis By Source, 2019-2023

10.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Source, 2024-2032

10.3.1. Corn

10.3.2. Wheat

10.3.3. Potato

10.3.4. Tapioca

10.3.5. Others

10.4. Market Attractiveness Analysis By Source

11. Global Clean Label Starch Market Analysis 2019-2032, By Application

11.1. Introduction / Key Findings

11.2. Historical Market Size (US$ Mn) and Volume Analysis By Application, 2019-2023

11.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Application, 2024-2032

11.3.1. Food & Beverage Industry

11.3.1.1. Dairy Products

11.3.1.2. Bakery & Confectionery

11.3.1.3. Soups, Sauces & Dressings

11.3.1.4. Infant Formula

11.3.1.5. Convenience Foods

11.3.1.6. Savory & Snacks

11.3.1.7. Beverages

11.3.1.8. Others

11.3.2. Animal Feed Industry

11.3.3. Pharmaceutical

11.3.4. Others

11.4. Market Attractiveness Analysis By Application

12. Global Clean Label Starch Market Analysis 2019-2032, by Region

12.1. Introduction

12.2. Historical Market Size (US$ Mn) and Volume Analysis By Region, 2019-2023

12.3. Current Market Size (US$ Mn) and Volume Analysis and Forecast By Region, 2024-2032

12.3.1. North America

12.3.2. Latin America

12.3.3. Europe

12.3.4. East Asia

12.3.5. South Asia and Pacific

12.3.6. Middle East and Africa (MEA)

12.4. Market Attractiveness Analysis By Region

13. North America Clean Label Starch Market Analysis 2019-2032

13.1. Introduction

13.2. Pricing Analysis

13.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

13.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

13.4.1. By Country

13.4.1.1. U.S.

13.4.1.2. Canada

13.4.2. By Form

13.4.3. By Source

13.4.4. By Application

13.5. Market Attractiveness Analysis

13.5.1. By Country

13.5.2. By Form

13.5.3. By Source

13.5.4. By Application

13.6. Market Trends

13.7. Key Market Participants – Intensity Mapping

13.8. Drivers and Restraints – Impact Analysis

14. Latin America Clean Label Starch Market Analysis 2019-2032

14.1. Introduction

14.2. Pricing Analysis

14.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

14.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

14.4.1. By Country

14.4.1.1. Brazil

14.4.1.2. Mexico

14.4.1.3. Argentina

14.4.1.4. Rest of Latin America

14.4.2. By Form

14.4.3. By Source

14.4.4. By Application

14.5. Market Attractiveness Analysis

14.5.1. By Country

14.5.2. By Form

14.5.3. By Source

14.5.4. By Application

14.6. Market Trends

14.7. Key Market Participants – Intensity Mapping

14.8. Drivers and Restraints – Impact Analysis

15. Europe Clean Label Starch Market Analysis 2019-2032

15.1. Introduction

15.2. Pricing Analysis

15.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

15.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

15.4.1. By Country

15.4.1.1. Germany

15.4.1.2. Italy

15.4.1.3. France

15.4.1.4. U.K.

15.4.1.5. Spain

15.4.1.6. BENELUX

15.4.1.7. Nordic

15.4.1.8. Russia

15.4.1.9. Poland

15.4.1.10. Rest of Europe

15.4.2. By Form

15.4.3. By Source

15.4.4. By Application

15.5. Market Attractiveness Analysis

15.5.1. By Country

15.5.2. By Form

15.5.3. By Source

15.5.4. By Application

15.6. Market Trends

15.7. Key Market Participants – Intensity Mapping

15.8. Drivers and Restraints – Impact Analysis

16. South Asia and Pacific Clean Label Starch Market Analysis 2019-2032

16.1. Introduction

16.2. Pricing Analysis

16.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

16.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

16.4.1. By Country

16.4.1.1. India

16.4.1.2. ASEAN

16.4.1.3. Oceania (Australia & New Zealand)

16.4.1.4. Rest of South Asia & Pacific

16.4.2. By Form

16.4.3. By Source

16.4.4. By Application

16.5. Market Attractiveness Analysis

16.5.1. By Country

16.5.2. By Form

16.5.3. By Source

16.5.4. By Application

16.6. Market Trends

16.7. Key Market Participants – Intensity Mapping

16.8. Drivers and Restraints – Impact Analysis

17. East Asia Clean Label Starch Market Analysis 2019-2032

17.1. Introduction

17.2. Pricing Analysis

17.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

17.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

17.4.1. By Country

17.4.1.1. China

17.4.1.2. Japan

17.4.1.3. South Korea

17.4.2. By Form

17.4.3. By Source

17.4.4. By Application

17.5. Market Attractiveness Analysis

17.5.1. By Country

17.5.2. By Form

17.5.3. By Source

17.5.4. By Application

17.6. Market Trends

17.7. Key Market Participants – Intensity Mapping

17.8. Drivers and Restraints – Impact Analysis

18. Middle East and Africa Clean Label Starch Market Analysis 2019-2032

18.1. Introduction

18.2. Pricing Analysis

18.3. Historical Market Size (US$ Mn) and Volume Trend Analysis By Market Taxonomy, 2019-2023

18.4. Market Size (US$ Mn) and Volume Forecast By Market Taxonomy, 2024-2032

18.4.1. By Country

18.4.1.1. GCC Countries

18.4.1.2. Turkey

18.4.1.3. Northern Africa

18.4.1.4. South Africa

18.4.1.5. Rest of Middle East and Africa

18.4.2. By Form

18.4.3. By Source

18.4.4. By Application

18.5. Market Attractiveness Analysis

18.5.1. By Country

18.5.2. By Form

18.5.3. By Source

18.5.4. By Application

18.6. Market Trends

18.7. Key Market Participants – Intensity Mapping

18.8. Drivers and Restraints – Impact Analysis

19. Country Wise Clean Label Starch Market Analysis, 2024

19.1. Introduction

19.1.1. Market Value Proportion Analysis, By Key Countries

19.1.2. Global Vs. Country Growth Comparison

19.2. U.S. Clean Label Starch Market Analysis

19.2.1. By Form

19.2.2. By Source

19.2.3. By Application

19.3. Canada Clean Label Starch Market Analysis

19.3.1. By Form

19.3.2. By Source

19.3.3. By Application

19.4. Mexico Clean Label Starch Market Analysis

19.4.1. By Form

19.4.2. By Source

19.4.3. By Application

19.5. Brazil Clean Label Starch Market Analysis

19.5.1. By Form

19.5.2. By Source

19.5.3. By Application

19.6. Argentina Clean Label Starch Market Analysis

19.6.1. By Form

19.6.2. By Source

19.6.3. By Application

19.7. Germany Clean Label Starch Market Analysis

19.7.1. By Form

19.7.2. By Source

19.7.3. By Application

19.8. Italy Clean Label Starch Market Analysis

19.8.1. By Form

19.8.2. By Source

19.8.3. By Application

19.9. France Clean Label Starch Market Analysis

19.9.1. By Form

19.9.2. By Source

19.9.3. By Application

19.10. U.K. Clean Label Starch Market Analysis

19.10.1. By Form

19.10.2. By Source

19.10.3. By Application

19.11. Spain Clean Label Starch Market Analysis

19.11.1. By Form

19.11.2. By Source

19.11.3. By Application

19.12. Russia Clean Label Starch Market Analysis

19.12.1. By Grade

19.12.2. By Source

19.12.3. By Source

19.12.4. By Application

19.12.5. By Extract Source

19.13. Poland Clean Label Starch Market Analysis

19.13.1. By Form

19.13.2. By Source

19.13.3. By Application

19.14. China Clean Label Starch Market Analysis

19.14.1. By Form

19.14.2. By Source

19.14.3. By Application

19.15. Japan Clean Label Starch Market Analysis

19.15.1. By Form

19.15.2. By Source

19.15.3. By Application

19.16. S. Korea Clean Label Starch Market Analysis

19.16.1. By Form

19.16.2. By Source

19.16.3. By Application

19.17. India Clean Label Starch Market Analysis

19.17.1. By Form

19.17.2. By Source

19.17.3. By Application

19.18. Turkey Clean Label Starch Market Analysis

19.18.1. By Form

19.18.2. By Source

19.18.3. By Application

19.19. South Africa Clean Label Starch Market Analysis

19.19.1. By Form

19.19.2. By Source

19.19.3. By Application

20. Market Structure Analysis

20.1. Market Analysis by Tier of Companies (Clean Label Starch)

20.2. Market Share Analysis of Top Players

20.3. Market Presence Analysis

21. Competition Analysis

21.1. Competition Dashboard

21.2. Competition Benchmarking

21.3. Competition Deep Dive

21.3.1. Archer Daniels Midland Company

21.3.1.1. Overview

21.3.1.2. Product Portfolio

21.3.1.3. Profitability by Market Segments (Product/Channel/Region)

21.3.1.4. Sales Footprint

21.3.1.5. Strategy Overview

21.3.2. Tate & Lyle

21.3.2.1. Overview

21.3.2.2. Product Portfolio

21.3.2.3. Profitability by Market Segments (Product/Channel/Region)

21.3.2.4. Sales Footprint

21.3.2.5. Strategy Overview

21.3.3. Roquette Frères S.A.

21.3.3.1. Overview

21.3.3.2. Product Portfolio

21.3.3.3. Profitability by Market Segments (Product/Channel/Region)

21.3.3.4. Sales Footprint

21.3.3.5. Strategy Overview

21.3.4. Cargill, Incorporated

21.3.4.1. Overview

21.3.4.2. Product Portfolio

21.3.4.3. Profitability by Market Segments (Product/Channel/Region)

21.3.4.4. Sales Footprint

21.3.4.5. Strategy Overview

21.3.5. BENEO GmbH

21.3.5.1. Overview

21.3.5.2. Product Portfolio

21.3.5.3. Profitability by Market Segments (Product/Channel/Region)

21.3.5.4. Sales Footprint

21.3.5.5. Strategy Overview

21.3.6. Emsland Group

21.3.6.1. Overview

21.3.6.2. Product Portfolio

21.3.6.3. Profitability by Market Segments (Product/Channel/Region)

21.3.6.4. Sales Footprint

21.3.6.5. Strategy Overview

21.3.7. SMS Corporation

21.3.7.1. Overview

21.3.7.2. Product Portfolio

21.3.7.3. Profitability by Market Segments (Product/Channel/Region)

21.3.7.4. Sales Footprint

21.3.7.5. Strategy Overview

21.3.8. Cooperatie Koninklijke Avebe U.A.

21.3.8.1. Overview

21.3.8.2. Product Portfolio

21.3.8.3. Profitability by Market Segments (Product/Channel/Region)

21.3.8.4. Sales Footprint

21.3.8.5. Strategy Overview

21.3.9. MGP Ingredients, Inc.

21.3.9.1. Overview

21.3.9.2. Product Portfolio

21.3.9.3. Profitability by Market Segments (Product/Channel/Region)

21.3.9.4. Sales Footprint

21.3.9.5. Strategy Overview

21.3.10. Lyckeby Starch AB

21.3.10.1. Overview

21.3.10.2. Product Portfolio

21.3.10.3. Profitability by Market Segments (Product/Channel/Region)

21.3.10.4. Sales Footprint

21.3.10.5. Strategy Overview

21.3.11. KMC Kartoffelmelcentralen A.M.B.A

21.3.11.1. Overview

21.3.11.2. Product Portfolio

21.3.11.3. Profitability by Market Segments (Product/Channel/Region)

21.3.11.4. Sales Footprint

21.3.11.5. Strategy Overview

21.3.12. Banpong Tapioca Flour Industrial Co., Ltd.

21.3.12.1. Overview

21.3.12.2. Product Portfolio

21.3.12.3. Profitability by Market Segments (Product/Channel/Region)

21.3.12.4. Sales Footprint

21.3.12.5. Strategy Overview

21.3.13. Blattmann Schweiz AG

21.3.13.1. Overview

21.3.13.2. Product Portfolio

21.3.13.3. Profitability by Market Segments (Product/Channel/Region)

21.3.13.4. Sales Footprint

21.3.13.5. Strategy Overview

21.3.14. Axereal

21.3.14.1. Overview

21.3.14.2. Product Portfolio

21.3.14.3. Profitability by Market Segments (Product/Channel/Region)

21.3.14.4. Sales Footprint

21.3.14.5. Strategy Overview

21.3.15. Ingredion Incorporated

21.3.15.1. Overview

21.3.15.2. Product Portfolio

21.3.15.3. Profitability by Market Segments (Product/Channel/Region)

21.3.15.4. Sales Footprint

21.3.15.5. Strategy Overview

21.3.16. AGRANA Beteiligungs-AG

21.3.16.1. Overview

21.3.16.2. Product Portfolio

21.3.16.3. Profitability by Market Segments (Product/Channel/Region)

21.3.16.4. Sales Footprint

21.3.16.5. Strategy Overview

Note: The list of companies above is tentative and it is subjected to change based on research process and/or customization requirements.

22. Assumptions and Acronyms Used

23. Research Methodology