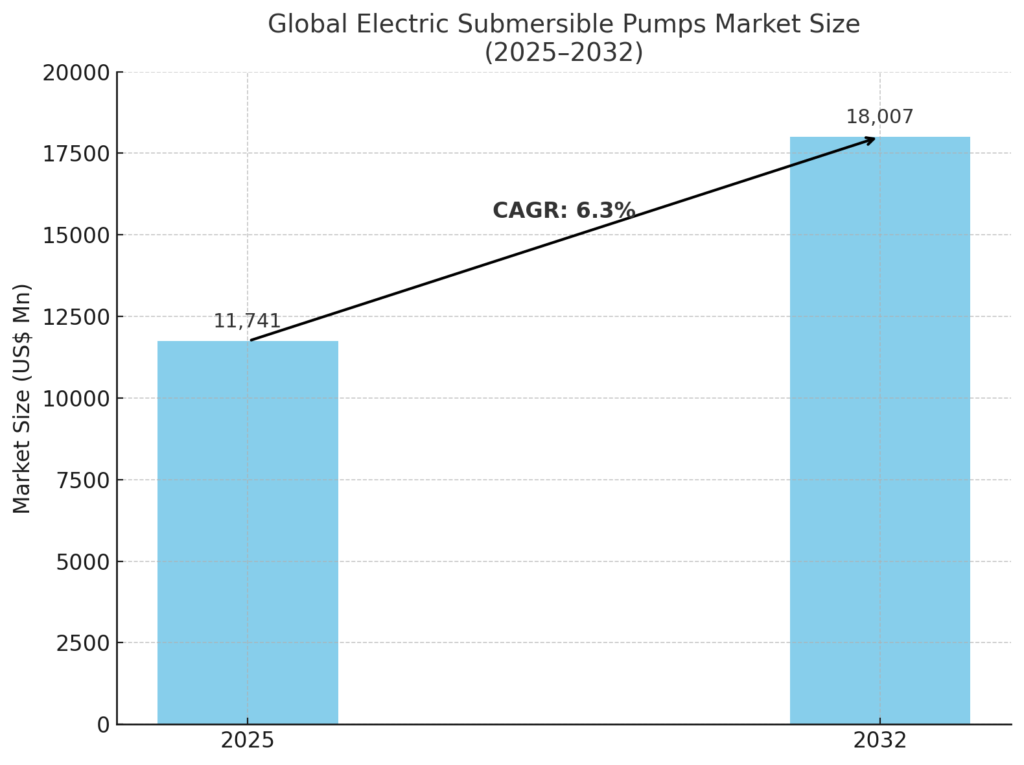

Electric Submersible Pumps (ESP) Market Overview (2025–2032)

The global electric submersible pumps (ESP) market is projected to expand significantly from USD 11.7 billion in 2025 to USD 18.0 billion by 2032, registering a CAGR of 6.3%. This growth is driven by a robust rise in demand across key end-use industries such as oil & gas, wastewater treatment, mining, construction, and agriculture. The need for energy-efficient, high-performance pumping systems that can operate reliably in harsh and high-demand environments remains a critical factor shaping the industry.

Key Market Drivers

-

Oil & Gas Sector Dominance

The oil & gas industry continues to be the leading contributor to ESP demand, accounting for approximately 45.3% of the market in 2025. With global oil demand expected to reach 103.9 million barrels per day in 2025, and significant production activity in the U.S., Kazakhstan, and the Middle East, ESPs are increasingly used for artificial lift and enhanced oil recovery operations. Mature fields and deeper wells necessitate reliable multistage pumping systems capable of operating under extreme pressure and temperature. -

Growing Investments in Wastewater Infrastructure

Urbanization, climate adaptation, and the push for sustainable water cycles have increased the emphasis on wastewater treatment systems. With only 52% of global wastewater currently treated—and stark disparities across income levels—investments are surging, particularly in low- and middle-income regions. This trend fuels demand for clog-resistant, low-maintenance ESPs in municipal and industrial applications. -

Agricultural and Mining Applications

Agriculture increasingly relies on ESPs for irrigation in voltage-unstable and water-scarce areas, while mining operations benefit from rugged, high-head pumps designed for dewatering and slurry transport. ESPs are now essential in these sectors for maintaining productivity and ensuring resilience amid growing resource constraints.

Technology and Product Innovation Trends

Product development is focused on improving energy efficiency, reliability, and application-specific performance. Leading manufacturers such as Sulzer, Xylem, and Kirloskar Brothers have introduced advanced models with features such as anti-clogging hydraulics (e.g., Sulzer’s ContraBlock Evo), energy optimization (e.g., Sulzer’s digital pump analytics), and extended service intervals (e.g., Xylem’s Flygt 2450 with up to 6,000 hours between servicing).

Digitalization is increasingly being embedded in pump systems to monitor performance, reduce carbon footprints, and enable predictive maintenance. These innovations are especially valuable in energy-intensive sectors such as oil & gas and mining.

Market Challenges

Despite its growth potential, the ESP market faces significant challenges, particularly high operational and maintenance costs in demanding environments. Corrosive fluids, abrasive solids, and fluctuating voltages can accelerate wear and tear, raising the total cost of ownership and deterring adoption in budget-constrained markets.

Opportunities

The expected oil supply surplus in 2025, coupled with rising demand in Asia, presents major opportunities for ESP manufacturers. Expanding oilfield operations, both offshore and onshore, and efforts to increase output from mature wells underscore the importance of ESPs for maintaining productivity. Government investments in infrastructure and clean water access further open up opportunities in developing countries, especially across Africa, South Asia, and Southeast Asia.

Additionally, regional manufacturing capabilities are expanding to meet local compliance standards and minimize logistical disruptions. For instance, Sulzer’s manufacturing expansion in South Carolina supports U.S. sourcing mandates such as the Build America Buy America Act (BABA Act).

Segmental Insights

-

By Operation Mode

The multistage segment dominates the ESP market with a projected 78.3% share in 2025. These systems are highly effective in deep-well and high-pressure applications, offering optimal performance in oil recovery and municipal dewatering. -

By Application

-

Oil & Gas: Continues to lead demand due to the need for artificial lift systems.

-

Water & Wastewater: Sees rapid growth due to infrastructure upgrades and environmental regulations.

-

Agriculture: Driven by irrigation needs in regions with erratic power supply.

-

Mining and Construction: ESPs are used for slurry handling, groundwater control, and dewatering.

-

Regional Market Trends

-

East Asia

East Asia holds around 24.5% of the global market share in 2025. China’s robust mineral production, industrial expansion, and demand for petrochemical feedstocks support significant ESP deployment. Japan and South Korea maintain steady use in industrial and municipal projects. -

Middle East & Africa (MEA)

The MEA region is a major hub for ESP demand, particularly in oil extraction and mining. Africa’s abundant mineral resources and water-stressed agricultural lands also drive ESP usage in dewatering and irrigation. Construction growth in Gulf countries boosts further demand. -

Europe and North America

While Europe’s fossil fuel production is declining, its advanced infrastructure in countries like Germany and Italy supports stable ESP adoption. In North America, high oil production in the U.S. and infrastructure developments sustain demand.

Competitive Landscape

The ESP market remains fragmented, with a mix of global and regional players. Key market participants include:

-

Sulzer (Switzerland)

-

Xylem Inc. (USA)

-

Kirloskar Brothers Limited (India)

-

Tsurumi Pump (Japan)

-

Grundfos (Denmark)

-

EBARA Corporation (Japan)

-

Weatherford, Hitachi America, and others

Rather than consolidation, competition is characterized by innovation, localization, and product specialization. Manufacturers are increasingly differentiating through technical improvements such as improved hydraulic systems, corrosion resistance, digital control, and long lifecycle.

Recent Key Developments

-

March 2025: Xylem launched the Flygt 2450, a heavy-duty submersible pump for mining applications with extended servicing intervals.

-

April 2024: Sulzer introduced the upgraded ContraBlock Evo hydraulics, enhancing energy efficiency and clog resistance for wastewater systems.

The global electric submersible pumps market is entering a phase of accelerated expansion fueled by energy demand, infrastructure investment, and industrial growth. With rising oilfield activity, digital transformation, and evolving regulatory landscapes, the industry is poised for sustained innovation and regional diversification. Tailored solutions addressing sector-specific challenges will continue to be the key to growth in this dynamic market.

Table of Content

- Executive Summary

- Global Electric Submersible Pumps Market Snapshot, 2025 and 2032

- Market Opportunity Assessment, 2025 – 2032, US$ Mn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Challenges

- Key Trends

- Product Lifecycle Analysis

- Macro-Economic Factors

- Global Sectorial Outlook

- Global GDP Growth Outlook

- Global Parent Market Overview

- Electric Submersible Pumps Market: Value Chain

- List of Operation Supplier

- List of Manufacturers

- List of Distributors

- List of End User

- Profitability Analysis

- Forecast Factors – Relevance and Impact

- Covid-19 Impact Assessment

- PESTLE Analysis

- Porter Five Force’s Analysis

- Geopolitical Tensions: Market Impact

- Regulatory and Operation Landscape

- Production Output , 2019 – 2024

- Production by Region

- Price Trend Analysis, 2019 – 2032

- Key Highlights

- Key Factors Impacting Product Prices

- Prices By Type/Operation/End Use

- Regional Prices and Product Preferences

- Global Electric Submersible Pumps Market Outlook: Historical (2019 – 2024) and Forecast (2025 – 2032)

- Key Highlights

- Market Size and Y-o-Y Growth

- Absolute $ Opportunity

- Market Size (US$ Mn) Volume (Unit) Analysis and Forecast

- Historical Market Size Analysis, 2019-2024

- Current Market Size Forecast, 2025-2032

- Global Electric Submersible Pumps Market Outlook: Type

- Introduction / Key Findings

- Historical Market Size (US$ Mn) and Volume (Unit) Analysis By Type, 2019 – 2024

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Type, 2025 – 2032

- Open well

- Borewell

- Market Attractiveness Analysis: Type

- Global Electric Submersible Pumps Market Outlook: Operation

- Introduction / Key Findings

- Historical Market Size (US$ Mn) and Volume (Unit) Analysis By Operation, 2019 – 2024

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Operation, 2025 – 2032

- Single Stage

- Multistage

- Market Attractiveness Analysis: Operation

- Global Electric Submersible Pumps Market Outlook: End Use

- Introduction / Key Findings

- Historical Market Size (US$ Mn) and Volume (Unit) Analysis By End Use , 2019 – 2024

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By End Use , 2025 – 2032

- Oil & Gas

- Water & Wastewater

- Construction

- Mining

- Agriculture

- Chemicals

- Misc.

- Market Attractiveness Analysis: End Use

- Key Highlights

- Global Electric Submersible Pumps Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Mn) and Volume (Unit) Analysis By Region, 2019 – 2024

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Region, 2025 – 2032

- North America

- Europe

- East Asia

- South Asia and Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Electric Submersible Pumps Market Outlook: Historical (2019 – 2024 ) and Forecast (2025 – 2032)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) and Volume (Unit) Analysis By Market, 2019 – 2024

- By Country

- By Type

- By Operation

- By End Use

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Country, 2025 – 2032

- U.S.

- Canada

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Type, 2025 – 2032

- Open well

- Borewell

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Operation, 2025 – 2032

- Single Stage

- Multistage

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By End Use , 2025 – 2032

- Oil & Gas

- Water & Wastewater

- Construction

- Mining

- Agriculture

- Chemicals

- Misc.

- Market Attractiveness Analysis

- Europe Electric Submersible Pumps Market Outlook: Historical (2019 – 2024 ) and Forecast (2025 – 2032)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) and Volume (Unit) Analysis By Market, 2019 – 2024

- By Country

- By Type

- By Operation

- By End Use

- By End Use Current Market Size (US$ Mn) and Volume (Unit) Forecast By Country, 2025 – 2032

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- Türkiye

- Rest of Europe

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Type, 2025 – 2032

- Open well

- Borewell

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Operation, 2025 – 2032

- Single Stage

- Multistage

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By End Use , 2025 – 2032

- Oil & Gas

- Water & Wastewater

- Construction

- Mining

- Agriculture

- Chemicals

- Misc.

- Market Attractiveness Analysis

- East Asia Electric Submersible Pumps Market Outlook: Historical (2019 – 2024 ) and Forecast (2025 – 2032)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) and Volume (Unit) Analysis By Market, 2019 – 2024

- By Country

- By Type

- By Operation

- By End Use

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Country, 2025 – 2032

- China

- Japan

- South Korea

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Type, 2025 – 2032

- Open well

- Borewell

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Operation, 2025 – 2032

- Single Stage

- Multistage

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By End Use , 2025 – 2032

- Oil & Gas

- Water & Wastewater

- Construction

- Mining

- Agriculture

- Chemicals

- Misc.

- Market Attractiveness Analysis

- South Asia & Oceania Electric Submersible Pumps Market Outlook: Historical (2019 – 2024 ) and Forecast (2025 – 2032)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) and Volume (Unit) Analysis By Market, 2019 – 2024

- By Country

- By Type

- By Operation

- By End Use

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Country, 2025 – 2032

- India

- Southeast Asia

- ANZ

- Rest of South Asia & Oceania

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Type, 2025 – 2032

- Open well

- Borewell

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Operation, 2025 – 2032

- Single Stage

- Multistage

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By End Use , 2025 – 2032

- Oil & Gas

- Water & Wastewater

- Construction

- Mining

- Agriculture

- Chemicals

- Misc.

- Market Attractiveness Analysis

- Latin America Electric Submersible Pumps Market Outlook: Historical (2019 – 2024 ) and Forecast (2025 – 2032)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) and Volume (Unit) Analysis By Market, 2019 – 2024

- By Country

- By Type

- By Operation

- By End Use

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Country, 2025 – 2032

- Brazil

- Mexico

- Rest of Latin America

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Type, 2025 – 2032

- Open well

- Borewell

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Operation, 2025 – 2032

- Single Stage

- Multistage

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By End Use , 2025 – 2032

- Oil & Gas

- Water & Wastewater

- Construction

- Mining

- Agriculture

- Chemicals

- Misc.

- Market Attractiveness Analysis

- Middle East & Africa Electric Submersible Pumps Market Outlook: Historical (2019 – 2024 ) and Forecast (2025 – 2032)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) and Volume (Unit) Analysis By Market, 2019 – 2024

- By Country

- By Type

- By Operation

- By End Use

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Country, 2025 – 2032

- GCC

- South Africa

- Northern Africa

- Rest of Middle East & Africa

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Type, 2025 – 2032

- Open well

- Borewell

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By Operation, 2025 – 2032

- Single Stage

- Multistage

- Current Market Size (US$ Mn) and Volume (Unit) Forecast By End Use , 2025 – 2032

- Oil & Gas

- Water & Wastewater

- Construction

- Mining

- Agriculture

- Chemicals

- Misc.

- Market Attractiveness Analysis

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Apparent Production Capacity

- Company Profiles (Details – Overview, Financials, Strategy, Recent Developments)

- Sulzer

- Overview

- Segments and Products

- Key Financials

- Market Developments

- Market Strategy

- Kirloskar Brothers Limited

- KSB Company

- Multiquip Inc.

- GRUNDFOS

- Hitachi America

- Xylem Inc.

- Caprari

- Crompton Greaves Consumer Electricals Limited

- Weatherford

- TSURUMI PUMP

- ZUWA-Zumpe GmbH

- Homa Pumpenfabrik GmbH

- Quadt Kunststoffapparatebau GmbH

- Sulzer

- Note: List of companies is not exhaustive in Nature. It is subject to further augmentation during course of research

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Report Purchase Information

| Attribute | Details |

|---|---|

| Report Price | USD 4,995 |

| Published Date | 13 June 2025 |

| Delivery Format | PDF & Excel |

| Number of Pages | 180 pages |

| Delivery Lead Time | Within 3 working days |

For direct email inquiries, please contact us at:

📩 mr@marketresearch.co.jp